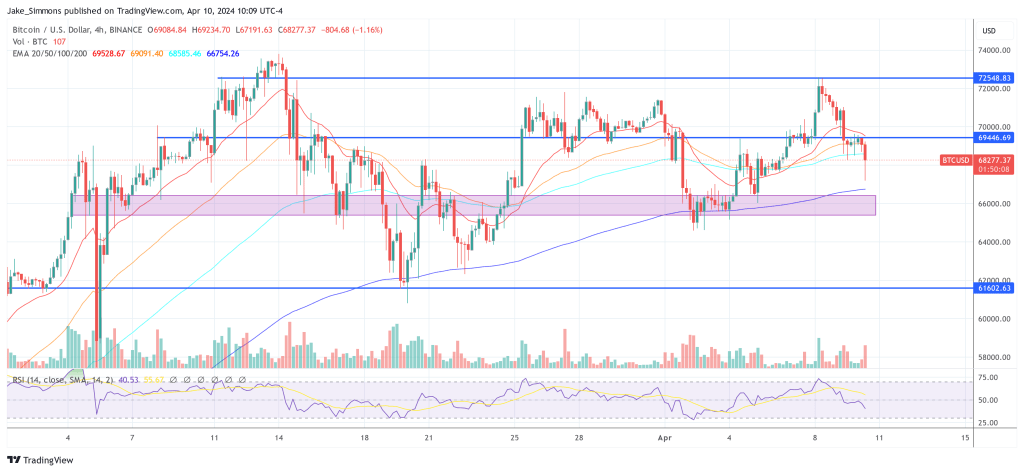

The latest Consumer Price Index (CPI) figures released by the United States have exceeded expectations, signaling a robust inflationary trend that could significantly influence the Federal Reserve’s forthcoming monetary policy decisions. The Bitcoin and crypto markets reacted with a swift downtrend. The BTC price initially dropped by 2.7%, falling below $67,200. Altcoins have reacted even more strongly to the data.

The non-seasonally adjusted CPI for March 2024 soared to an annual rate of 3.5%, surpassing both the anticipated figure of 3.4% and February’s rate of 3.2%, marking the highest inflation rate since September 2023. This uptick reflects not just a transient economic fluctuation but a deeper, more sustained inflationary pressure within the economy.

The details of the CPI report reveal that both the headline and core inflation rates, which exclude volatile food and energy prices, increased by 0.4% month-over-month. This uniform rise underscores a pervasive inflationary pressure across various sectors, not limited to volatile categories. The year-over-year core CPI maintained its pace at 3.8%, slightly ahead of market forecasts and unchanged from February, indicating that underlying inflation pressures remain persistent.

❖ U.S CPI (MOM) (MAR) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.3%

❖ U.S CPI (YOY) (MAR) ACTUAL: 3.5% VS 3.2% PREVIOUS; EST 3.4%

❖ U.S CORE CPI (MOM) (MAR) ACTUAL: 0.4% VS 0.4% PREVIOUS; EST 0.3%

❖ U.S CORE CPI (YOY) (MAR) ACTUAL: 3.8% VS 3.8% PREVIOUS; EST 3.7%

— *Walter Bloomberg (@DeItaone) April 10, 2024

Market Reactions And Federal Reserve’s Dilemma

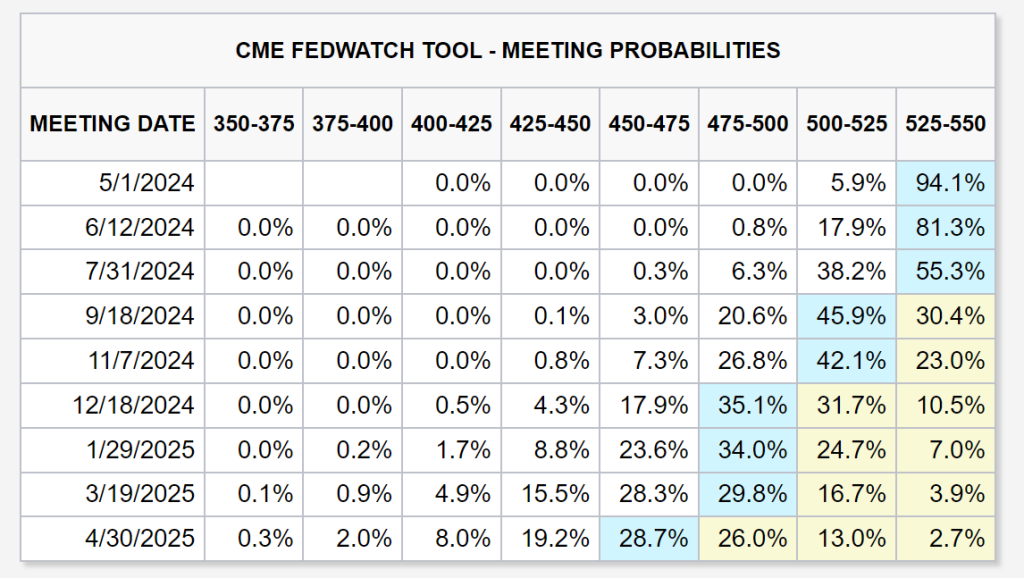

The market’s response to these figures was swift, with immediate implications for interest rate expectations. The swaps market, a reliable gauge of monetary policy expectations, showed a decreased likelihood of the Federal Reserve cutting interest rates in the near future. According to CME Group’s FedWatch tool, the probability that rates will remain unchanged at the Fed’s May meeting is now at 94.1%, with a 81.3% chance of holding steady through June.

Mohamed A. El-Erian, offering his perspective, stated, “The market is now pricing less than two Federal Reserve cuts this year as it takes another step in the “later and fewer” direction for the excessively dependent Fed. The major stock futures indices are down over 1%, and the dollar is stronger. All this puts the Fed in quite a tricky position — one in which it should take a holistic view of what’s ahead for the economy as a whole. But will it?”

Christopher Inks sought to temper reactions by reminding the public of the Fed’s preference for the Personal Consumption Expenditures (PCE) Price Index as its primary inflation measure.

“Since we are seeing people replying about what the Fed is going to do re: rate cuts as a result of the CPI release this morning, I will once again remind you that the Fed stopped focusing on the CPI about a decade ago. It’s preferred inflation gauge is the PCE which comes out at the end of the month,” Inks explained.

Implications For Bitcoin And The Crypto Market

The crypto market has been closely watching the data. Charles Edwards pointed out the adverse effects of rising inflation and decreasing liquidity on cryptocurrencies, stating, “Inflation rising again and more than expected. Likely related [to] why we saw liquidity start to fall the last weeks also. Not good for crypto if these two trends continue.”

Matt Hougan (CIO of Bitwise) and Dave Weisberger (Chairman of CoinRoutes) offered a contrary view, suggesting that current market conditions may actually favor cryptocurrencies in the long run. Hougan noted, “Whether the Fed cut rates 25bps in June or not isn’t the long-term driver of Bitcoin prices right now. It’s a marginal factor. ETF flows + rising deficits matter more, and they are lining up very well for Bitcoin.”

Weisberger, sharing Hougan’s optimism, added, “Agreed. My contrarian take is this is a buying opportunity as these numbers show the strongest cracks in the dollar hegemonic FIAT experiment yet… Gold, for the moment, is getting it right and Bitcoin will inevitably react. (In the meantime, the whale playbook of pushing the market down to buy cheaper is still alive…).”

At press time, BTC traded at $68,277.

Featured image from Shutterstock, chart from TradingView.com