- The Uniswap Foundation announced a delay to an upgrade vote on the protocol’s fee mechanism.

- UNI price reacted lower, declining 9% to hit lows of $10.17.

The Uniswap Foundation has postponed the governance vote on a proposal aimed at activating a new fee mechanism for the protocol. This proposal would have initiated a fee switch for Uniswap, providing for rewards to UNI token holders who stake and delegate their tokens.

As the market reacted to the news, the price of UNI fell by nearly 9% to touch lows of $10.17 across major exchanges.

Uniswap postpones key upgrade vote

Uniswap announced the fee switch proposal last week, with an on-chain deployment and vote set for today, Friday. However, this will now not go ahead as planned as per a new update.

In an update today, the Uniswap Foundation stated that the delay relates to an issue a stakeholder raised following the proposal. This has necessitated “additional diligence” on the part of the Foundation.

“Due to the immutable nature and sensitivity of our proposed upgrade, we have made the difficult decision to postpone posting this vote. This was unexpected, and we apologize for the postponement. We will keep the community apprised of any material changes and will update you all once we feel more certain about future timeframes,” the Uniswap Foundation noted via its official X account.

UNI price

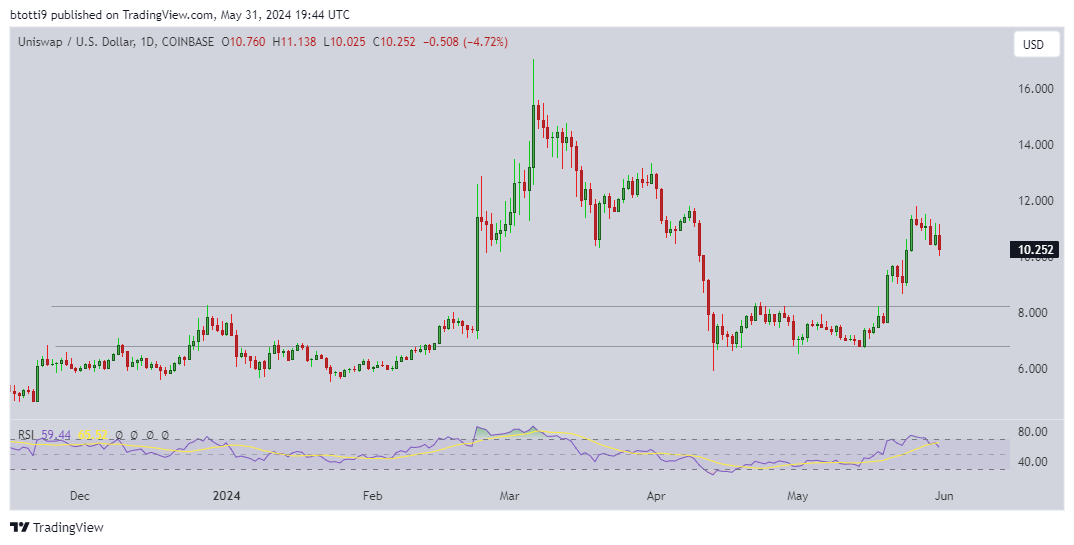

The UNI token traded to highs of $11.04 on Friday before the announcement saw the token’s value tumble.

UNI price has moved lower since hitting highs of $11.79 on May 26. The RSI on the daily chart suggests bears might yet target prices around the $10 level.

With Unswap price currently changing hands around $10.26, a breakdown below the psychological level could push it to support near $8.00.

As can be seen in the chart above, UNI price fluctuated within the $6.80-$8.22 range for several days before the breakout on May 20.