Gold, the original store of value, is inching closer to $3,000 and is currently trading above $2,700, printing fresh all-time highs in the process.

As the yellow metal stretches gains, capital may flow to Bitcoin, the digital alternative, forcing the world’s most valuable coin above $74,000.

3 Tons Of Gold Tokenized

While gold and Bitcoin have advantages, with the more suave favoring the fluidity of BTC, one holder seems to be interested in both.

A recent analysis by Arkham, a blockchain intelligence firm, reveals that one wallet holds over $250 million in Tether Gold. In the real world, this tokenized stash weighs approximately 3 tons.

For now, the owner of this tokenized stash remains unknown. However, using AI, Arkham speculates that the 3 tons of gold belong to RhinoFi. According to on-chain data, the layer-2 bridge has processed over $2.3 billion worth of assets from more than 48.8 million transactions. It currently bridges 31 chains, connecting over 2 million accounts.

Tether Gold is technically a stablecoin tracking the real-world value of gold. As of October 22, over 246,520 tokens of digital gold had been minted on Ethereum. According to Ethplorer, there are 2,618 token holders making more than 39,500 transfers.

Although it cannot be immediately determined that RhinoFi controls nearly 50% of all Tether Gold in circulation, tokenization is picking up traction. The success of USD-backed stablecoins like USDT and USDC and their widespread adoption, especially in emerging economies, explain why they are here to stay.

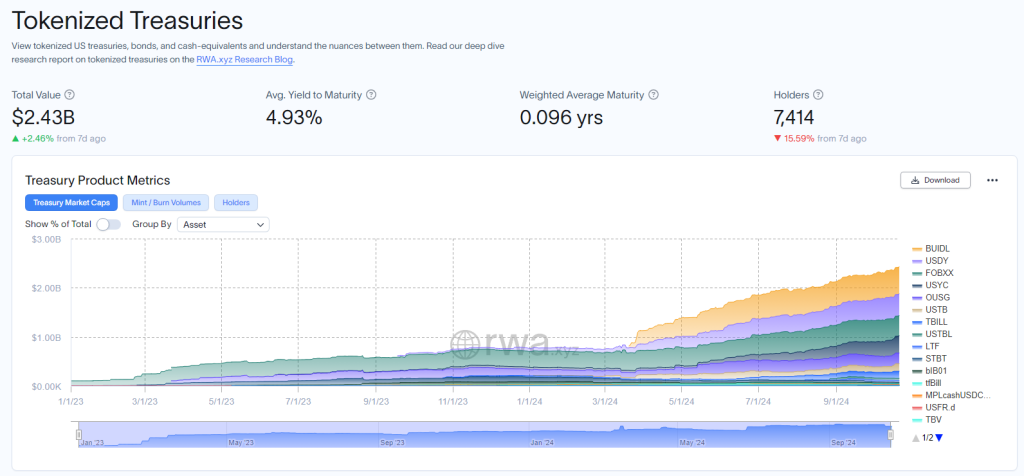

BlackRock Confident, Over $2.4 Billion Of US Treasuries, Bonds Lives Onchain

Converting real-world assets into tokens on public ledgers like Ethereum or Polygon makes it easier for users to transfer and gain exposure. The CEO of BlackRock predicts the tokenization market will command trillions in the next few years.

Coingecko data shows over $7.9 billion of assets have been tokenized. Most of them are on Ondo, Pendle, and Mantra. Beyond Tether Gold, other tokenized alternatives include Pax Gold and Quorium.

In addition to gold, real estate and United States Treasuries have been tokenized. BlackRock, one of the world’s largest asset managers, currently issues BUIDL on Ethereum.

Looking at rwa.xyz data, over $2.4 billion worth of United States treasuries, bonds, and other cash equivalents have been tokenized. BlackRock’s BUIDL currently manages over $550 million of tokenized treasuries.

Feature image from Pexels, chart from TradingView