The broadband market in Ireland has experienced significant evolution over the past two decades. Once characterised by limited choice, slow speeds, and high costs, the landscape has transformed into a dynamic and increasingly competitive industry. Spurred by governmental policy, infrastructural upgrades, and growing consumer demand, broadband has become an essential utility on par with electricity and water for most households and businesses.

Today, broadband is integral to everyday life—enabling remote work, distance learning, telehealth services, and the consumption of streaming media. The COVID-19 pandemic further underscored the importance of reliable high-speed internet, with large swathes of the population requiring consistent access for work and education from home. Meanwhile, the Irish government’s National Broadband Plan (NBP) aims to ensure that even the most remote rural areas have access to quality connectivity so that all citizens can benefit from digital opportunities.

This article delves into the current landscape of the Irish broadband market, examining its major providers, infrastructural developments, regulatory environment, and ongoing challenges. We will also look at emerging technologies, consumer trends, and the prospects for Ireland’s continued progress toward a fully connected society.

Background and Historical Context

The evolution of broadband in Ireland is closely tied to the country’s broader economic development and digital transformation efforts. In the early 2000s, internet access in Ireland was predominantly dial-up. Speeds were slow, and the market was largely controlled by the incumbent provider, Eircom (now known as Eir). Around that time, broadband began to roll out more widely, although initial coverage was patchy, and consumer choice was limited.

Throughout the 2000s, the Irish government recognised that the digital divide—between those who had access to high-speed internet and those who did not—posed a risk to Ireland’s competitive edge in the global marketplace. The government launched a series of initiatives and programs to stimulate infrastructure development in underserved areas. Notably, the National Broadband Scheme (NBS), which preceded the current National Broadband Plan, aimed to subsidise broadband deployment in rural and remote regions.

Competition slowly increased during this period as new providers entered the market with alternative technologies. Cable networks, for instance, offered faster speeds in certain urban areas, and satellite broadband solutions emerged for extremely remote locations where terrestrial infrastructure was not feasible. The rollout of mobile broadband became another important factor, with 3G and later 4G networks providing a wireless alternative to fixed-line services.

The mid to late 2010s brought further shifts. Ireland, in line with most of Europe, began focusing on fibre-to-the-home (FTTH) and fibre-to-the-cabinet (FTTC) solutions, aiming to significantly boost bandwidth capacity and future-proof networks for the data-intensive services that consumers and businesses increasingly required. This era also saw a swell of investment from private telecommunications companies, supported by a regulatory framework designed to encourage competition and protect consumer interests.

As Ireland’s technology sector flourished—attracting big names like Google, Facebook (Meta), and Microsoft to establish European headquarters—broadband infrastructure became even more critical. From supporting data centres to fostering remote work opportunities, high-speed and reliable connectivity emerged as a cornerstone of Ireland’s continued economic success.

Today, while there is still a divide between urban and rural broadband speeds and reliability, the overall state of the broadband market is far more robust and competitive than it was a decade ago. The current challenge is to ensure that upgrades continue apace, especially in rural areas, while maintaining competitive pricing and top-tier customer service.

Key Broadband Providers in Ireland

Ireland’s broadband market features a mix of incumbent players, international operators, and smaller, region-specific providers. The competitive environment ensures that consumers have more options than ever before, although availability can vary significantly based on geographic location. Some of the major providers include:

- Eir

- As the incumbent and historically dominant telecommunications provider, Eir operates a substantial copper and fibre network. In many parts of rural Ireland, Eir remains the primary or only fixed-line broadband option. They have invested heavily in fibre upgrades, transitioning from copper-based infrastructure toward more fibre-to-the-cabinet (FTTC) and fibre-to-the-home (FTTH) solutions.

- Eir is also active in the mobile broadband space, offering 4G and, in many areas, 5G services.

- Virgin Media

- Formerly UPC, Virgin Media is well-known for its cable broadband services, primarily concentrated in urban and suburban areas. Leveraging cable technology (DOCSIS 3.0 and 3.1 in some areas), Virgin Media has been able to offer some of the highest advertised speeds in Ireland.

- They also bundle broadband with TV and phone services, making them a popular choice for consumers looking for triple-play packages.

- Vodafone

- Vodafone entered Ireland’s fixed broadband market through partnerships and acquisitions, leveraging its strong brand presence in mobile services.

- It offers fixed broadband solutions—often via infrastructure-sharing arrangements or by partnering with the state for rural rollout—as well as mobile broadband options over its 4G and 5G networks.

- Sky

- Sky entered the Irish broadband market primarily by reselling access to Eir’s infrastructure. Its focus is often on bundled services (broadband + TV), leveraging the company’s well-known satellite TV offerings.

- While its infrastructure is not as extensive as Virgin or Eir’s, Sky has carved out a solid niche, particularly for consumers already subscribed to its TV packages.

- SIRO

- SIRO is a joint venture between the ESB (Electricity Supply Board) and Vodafone, aiming to deliver 100% fibre broadband to various towns and cities across Ireland. By using ESB’s existing electricity infrastructure, SIRO can bring high-speed connectivity directly to the home (FTTH).

- However, SIRO does not retail directly to consumers; instead, it partners with various retail service providers such as Digiweb, Vodafone, and others.

- Regional and Niche Providers

- A number of smaller providers exist to fill coverage gaps in areas where larger providers have been slow to expand. These range from fixed-wireless access (FWA) providers to smaller local ISPs that own some fibre infrastructure in targeted geographies.

- This regional focus can be vital for rural communities, where the combination of government subsidies and local market knowledge can deliver competitive broadband options that might otherwise be unavailable.

Market Structure and Competition

Ireland’s broadband market operates under a regulatory framework overseen by ComReg (the Commission for Communications Regulation). Competition is generally fostered through local loop unbundling (LLU) rules that require the incumbent operator (Eir) to provide wholesale access to competitors. This ensures multiple providers can offer services over the incumbent’s copper and fibre lines, fostering choice and theoretically driving down prices.

However, competition varies greatly by geography. Urban centres like Dublin, Cork, and Galway typically enjoy multiple infrastructure-based competitors—Eir, Virgin Media, SIRO-based providers, and others—offering a range of packages and price points. In more rural settings, the market often thins out to one or two providers, especially where FTTH has not yet been deployed. In these areas, consumers may resort to fixed-wireless or satellite broadband solutions if the legacy copper network proves insufficient for modern broadband speeds.

Despite these challenges, Ireland’s broadband market is considered moderately competitive by European standards. Consumers can often benefit from short-term promotions and bundle discounts (broadband, TV, mobile services). The primary ongoing concern is ensuring that infrastructure upgrades continue to expand beyond well-populated areas so that rural and semi-rural communities are not left behind.

Broadband Technologies in Ireland

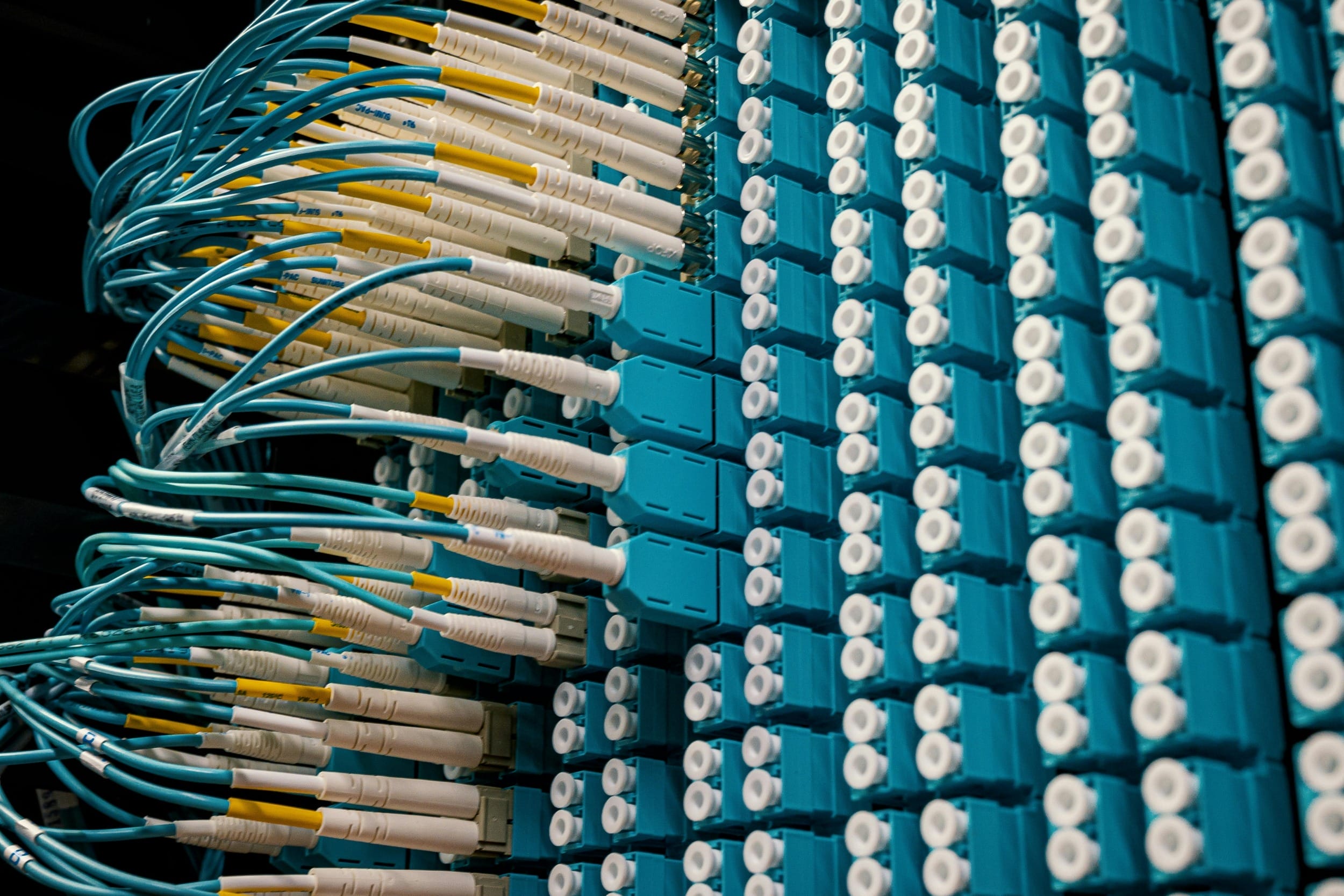

Photo by on Pexels

Irish consumers and businesses access broadband through a variety of technologies. Each has its own set of advantages, speed capabilities, and coverage limitations:

- Fiber-to-the-Home (FTTH) and Fiber-to-the-Cabinet (FTTC)

- FTTH provides the highest speeds, capable of delivering symmetrical bandwidth (upload speeds can match download speeds). In Ireland, SIRO and Eir are two of the primary operators rolling out FTTH networks, though coverage remains uneven.

- FTTC, where fibre is delivered to a street cabinet, and then copper (usually VDSL) is used to cover the “last mile” to the home, is more widespread. While FTTC speeds can be very high (sometimes up to 100 Mbps or more), they still rely on the quality of the copper line for the final connection.

- Cable Broadband

- Virgin Media’s network uses cable technology based on DOCSIS 3.0 and 3.1 standards. Cable can provide speeds comparable to FTTC and even rival FTTH under optimal conditions, though bandwidth can sometimes be shared among neighbours in the same area.

- Cable’s coverage is mostly in urban and suburban areas.

- Fixed-Wireless Access (FWA)

- Fixed-wireless solutions use radio links from a base station to a receiver on a building. Providers often target rural areas where running fibre or upgrading copper lines is not cost-effective.

- Speeds can vary widely, and line-of-sight obstacles—like hills and trees—can impact quality. However, advancements in wireless technology have improved reliability and bandwidth in recent years.

- Mobile Broadband (4G and 5G)

- Mobile broadband is popular for those who do not have access to reliable fixed-line services or need internet on the go. With the rise of unlimited data packages, some consumers in rural areas opt for mobile broadband as their primary home connection.

- 5G rollouts by Vodafone, Eir, and Three are still ongoing, especially in major population centres, with coverage steadily expanding.

- Satellite Broadband

- Satellite broadband is often considered a last resort in extremely remote locations. While coverage is nearly universal, latency can be high due to the signal travelling to and from geostationary satellites. Additionally, data caps and higher costs have historically been barriers.

- Newer Low-Earth Orbit (LEO) satellite constellations like Starlink offer significantly lower latency and higher speeds compared to traditional satellite solutions, but availability and cost remain considerations.

With Ireland’s diverse topography and a mix of urban and remote rural settings, a one-size-fits-all broadband solution is impractical. Consequently, policymakers and providers often embrace a multi-technology approach to maximise coverage.

Regulatory Environment and Government Initiatives

Ensuring that broadband services are widely available and affordable is a core part of Ireland’s national development strategy. The key government body overseeing telecommunications regulation is ComReg, which focuses on promoting competition and protecting consumers. ComReg’s powers include setting wholesale pricing, overseeing service quality, and adjudicating disputes among operators.

However, the most transformative government initiative in recent years is the National Broadband Plan (NBP). Launched to bridge Ireland’s digital divide, the NBP aims to deliver high-speed broadband to every home and business in the country—particularly in the “Intervention Area,” where commercial operators do not have the financial incentive to deploy networks on their own.

National Broadband Plan (NBP)

- Scope and Objectives

The NBP covers around 564,000 premises in rural areas, representing nearly 1.1 million people, including a significant number of farms, schools, and businesses. The goal is to provide minimum speeds of 150 Mbps, effectively future-proofing connections for modern digital needs. - Implementation Phases

- Phase 1: Preliminary planning, mapping, and establishing the intervention area. This included detailed geospatial surveys to determine which premises were connected or connectable by commercial operators versus those without any foreseeable commercial network rollout.

- Phase 2: The contract award process, culminating in the selection of National Broadband Ireland (NBI) to build, operate, and maintain the NBP network for 25 years.

- Phase 3: The ongoing network build-out and connection of homes and businesses. Deployment is planned in waves, with some initial pilot areas already live and others scheduled to come online progressively over the coming years.

- Funding

Funding for the NBP is a combination of state subsidy and private investment. The exact cost and timeline have been subjects of debate and controversy, partly due to the scale of the project and the complexities of deploying fibre in remote areas. - Impacts and Challenges

- Rural Connectivity: The NBP is expected to significantly reduce the urban-rural broadband gap, allowing remote communities to fully participate in digital activities like e-commerce, telehealth, and online education.

- Implementation Delays: Large-scale infrastructure projects are often prone to delays, whether due to logistical hurdles, procurement issues, or the complexities of laying fibre across difficult terrain.

- Competition Concerns: Some critics argue that the intervention might distort the market if not handled carefully, although the alternative could be leaving large rural areas underserved.

Other Regulatory Measures

Beyond the NBP, ComReg and the government have taken various steps to keep the market competitive:

- Spectrum Auctions: Periodically auctioning off spectrum for mobile broadband, including 5G frequencies.

- Wholesale Access Requirements: Mandating that Eir and other network owners offer fair wholesale prices to competitors, thereby encouraging market entry and limiting monopolistic practices.

- Consumer Protection: Monitoring service quality, requiring providers to be transparent about broadband speeds, and providing mechanisms for consumer complaints and redress.

The regulatory environment, combined with the ambitious NBP, underscores Ireland’s commitment to making high-speed broadband a universal service.

Consumer Trends and Usage Patterns

Photo by on Pexels

Demand for higher bandwidth continues to surge as Irish consumers increasingly rely on streaming services (Netflix, Amazon Prime Video, Disney+, etc.), online gaming, cloud-based work applications, and remote education tools. A few notable trends:

- Cord-Cutting and Streaming

Consumers are shifting from traditional pay-TV packages toward online streaming platforms. This puts pressure on broadband providers to offer higher bandwidth and more robust data allowances. - Remote Work

Even as pandemic restrictions have eased, hybrid and remote work models remain popular. Many employers in Ireland see remote or flexible work as a perk that boosts employee satisfaction and retention. Reliable broadband is thus becoming a prerequisite for many Irish homes, influencing decisions about where people can live and work. - Smart Home Adoption

From smart speakers to energy monitors and security cameras, the Internet of Things (IoT) is becoming more common in Irish households. Each device adds to overall bandwidth consumption and underscores the need for consistently high-speed connections. - Mobile-First Usage

Ireland has a high smartphone penetration rate. Many consumers use their mobile devices as a primary or secondary internet connection, especially younger demographics. 5G networks are expected to accelerate this trend, though fixed broadband remains crucial for data-intensive tasks like 4K streaming and large file transfers.

Challenges and Ongoing Developments

Despite the overall positive trajectory, the Irish broadband market faces several obstacles and uncertainties:

- Rural Coverage and Deployment Delays

- Rolling out infrastructure in sparsely populated areas is capital-intensive, which is why the NBP is critical. Any significant delays in the plan’s execution prolong the digital divide, affecting economic opportunities and quality of life.

- Cost Pressures

- Even with growing competition, broadband can still be expensive relative to other European markets, particularly for premium high-speed or unlimited data packages. Providers also face cost pressures—from upgrading networks to deploying 5G—and these can be passed on to consumers.

- Customer Service and Reliability

- Consumers frequently voice concerns about the quality of customer support, billing transparency, and actual versus advertised speeds. While ComReg enforces speed-advertising guidelines, many users in rural or suburban fringe areas still receive speeds below advertised rates due to copper line limitations or network congestion.

- Technological Shifts

- The telecom industry is in the midst of multiple technological evolutions, from 5G to LEO satellite internet. Providers that are slow to adapt or invest risk losing market share. At the same time, new entrants leveraging alternative technologies can disrupt the market dynamics if they offer better reliability or lower prices.

- Brexit and Supply Chain Considerations

- Although Ireland remains in the EU, changes to customs and supply chain flows can affect the importation of networking equipment and skilled labour. This has the potential to cause complications or delays in infrastructure projects.

Ongoing developments—such as the expansion of SIRO’s fibre network, the rollout of 5G across major operators, and pilot programs for newer satellite broadband—keep the market in a state of constant flux. Regulators, operators, and policymakers need to remain agile in adapting to these emerging realities.

The Future of Broadband in Ireland

Ireland’s broadband future is poised for several significant transitions. Here are some key areas to watch:

- Expansion of Fiber Networks

- As the NBP continues, fibre infrastructure will inch closer to universal coverage. Competition between providers like Eir, SIRO, and Virgin Media could drive further investments and faster deployment timelines, especially in suburban areas.

- Over the next decade, copper-based networks will likely be phased out in favour of fibre, at least in areas where it’s economically viable.

- 5G Proliferation and Beyond

- As 5G coverage expands, mobile broadband could become a serious competitor to fixed-line services, particularly for those who prioritise flexibility and do not require ultra-high capacities like heavy gamers or large households.

- Future innovations, including the potential emergence of 6G standards, might further blur the line between fixed and mobile broadband.

- LEO Satellite Services

- Starlink and similar LEO constellations have started providing service in Ireland, offering relatively high speeds and low latency compared to legacy satellite systems. This could be especially transformative for areas where even fixed-wireless solutions struggle.

- However, pricing and equipment costs remain relatively high, so mass adoption depends on competitive packages and stable performance.

- Smart Homes, IoT, and Edge Computing

- As smart devices multiply, the demand on broadband networks will grow exponentially. Edge computing could mitigate some load by processing data closer to the point of collection, but high-speed connections will still be essential to link these local edge nodes to the cloud.

- This evolution could drive further infrastructure investments and specialised broadband packages optimised for IoT ecosystems.

- Regulatory Developments

- The Irish government and ComReg will continue to refine regulations to foster competition, protect consumers, and encourage ongoing investment in infrastructure.

- Measures to ensure net neutrality, transparent advertising of speeds, and effective consumer redress systems will likely remain top priorities.

With the convergence of public policy, private investment, and technological innovations, Ireland’s broadband landscape will likely become even more competitive and sophisticated in the coming years. The overarching objective is clear: ensuring that all citizens, regardless of their location, can access affordable, reliable, and fast broadband.

Conclusion

The Irish broadband market is a dynamic arena marked by evolving technologies, heightened competition, and strong governmental involvement. From its modest beginnings in the early 2000s, the country’s broadband infrastructure has transformed significantly, bringing faster speeds and more widespread coverage to millions of households and businesses. Yet, challenges remain—notably ensuring that rural areas and underserved communities gain equitable access to modern broadband services.

The National Broadband Plan stands as a central pillar of Ireland’s telecommunications strategy. If successfully executed, it will bridge much of the remaining digital divide, bringing fibre connectivity to regions that historically languished on slow or unreliable connections. Meanwhile, established providers like Eir, Virgin Media, Vodafone, and Sky, along with newer ventures like SIRO, are pushing forward with their own network expansions. These efforts, combined with regulatory measures, are aimed at delivering high-speed internet to as many people as possible at competitive prices.

Consumer demand also shapes the market’s evolution. Remote and hybrid work arrangements, increasing reliance on streaming services, and the proliferation of smart home devices all indicate a future in which robust, high-speed connectivity is indispensable. In response, operators are not only upgrading their networks but also innovating with new service packages, bundling, and emerging access technologies like 5G and LEO satellite broadband.

Over the next decade, Ireland’s broadband sector will likely continue its rapid transformation. While cost, coverage, and service quality will remain areas of concern, the momentum toward universal, high-speed internet access seems irreversible. As with any large-scale infrastructure endeavour, the final picture may not be without imperfections, but the trend lines point to a more inclusive, better-connected Ireland, where broadband is a given rather than a luxury.

With sustained commitment from government, industry, and the public, Ireland stands on the cusp of achieving its vision for ubiquitous, world-class connectivity—positioning the country to stay competitive in the global digital economy and ensuring that the benefits of the internet are accessible to all.

Disclaimer: AI-Assisted Content

This article was created with the assistance of AI tools and is part of our broader research into how this technology is disrupting the industry we work in. If you notice any errors or inaccuracies, please feel free to reach out.