A chunky monthly income without working for it sounds great. But realistically, it would require £480,000 invested in the stock market in order to earn, say, £2,000 a month as a second income. That’s built on owning a portfolio invested in stocks or bonds that collectively delivers a 5% yield.

Of course, unless perfectly planned, these stocks are unlikely to actually deliver £2,000 every month. Stocks typically pay their dividends once or twice a year, and this can result in investors receiving more in some months and less in others.

However, the path to achieving £24,000 a year is realistic. It’s just not a part of a get-rich-quick scheme. This takes time and perseverance.

Starting from scratch

So what’s the formula? Well, it requires a would-be investor to open a Stocks and Shares ISA through any major UK brokerage. This part’s simple. Next, they’d need to commit to making a regular contribution to this account. In this case, £500 a month would be perfect.

Many novices start by investing in funds that seek to track the performance of global stocks or specific indexes. This is arguably the lowest risk way to invest in the stock market.

However, some investors may seek to beat the market. And this will likely involve investing in a more selective group of stocks with high potential or overlooked valuations.

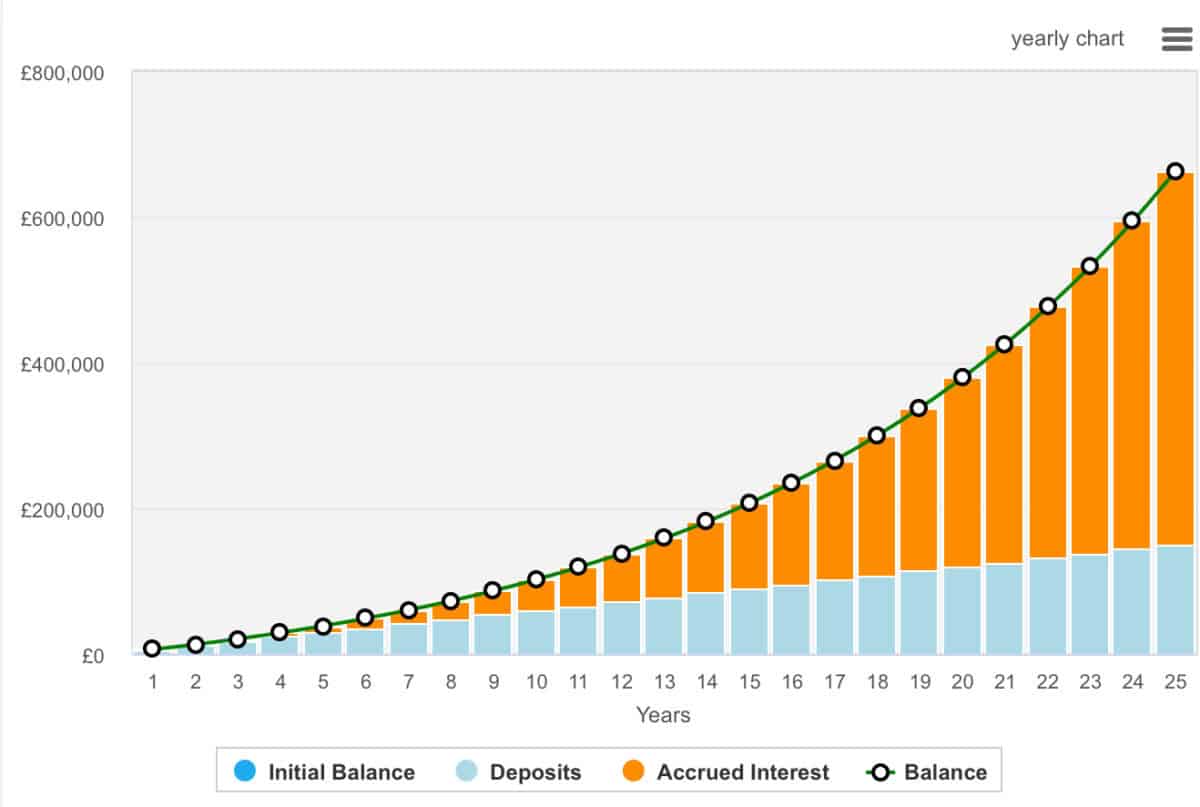

An experienced or well-informed investor may seek to achieve a 10% annualised return. Leveraging this £500 of monthly contributions, an investor could turn an empty portfolio into one worth £480,000 in a little over 22 years. Here’s how it compounds.

What’s more, when achieved in a Stocks and Shares ISA, everything’s shielded from tax. There’s no capital gains to slow our portfolio growth and no income tax to hammer our dividends.

Investors simply need to be aware that poor decisions can result in them losing money.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Investing to beat the market

Scottish Mortgage Investment Trust‘s (LSE:SMT) a UK-based investment trust that aims to outperform the market by focusing on high-growth, innovative companies worldwide.

Managed by Baillie Gifford, the trust invests in disruptive industries such as artificial intelligence (AI), electric vehicles (EVs), and digital platforms, selecting businesses that have the potential to reshape their sectors.

This approach includes both public equities and private companies like SpaceX, with a flexible, long-term investment horizon.

The trust takes a global perspective, unconstrained by geography or sector, allowing it to back companies that represent the future of their industries wherever they may be. While it has lowered its exposure to China, the trust continues to invest globally.

However, investors should be wary that the trust practices gearing (borrowing to invest). And while this can help the trust build its portfolio, it also magnifies losses when the market goes into reverse.

Nonetheless, its forward-looking, growth-oriented strategy helps explain its historic ability to outperform global benchmarks. And this is why it’s a core part of mine and my daughter’s portfolios. I absolutely believe it’s worth considering.