According to the consensus of analysts covering the London Stock Exchange Group (LSE:LSEG), it’s the most undervalued company on the FTSE 100.

Now, analysts’ forecasts can be misleading. Sometimes there just aren’t many covering a stock and a consensus of two analysts isn’t much of a consensus. And some simply aren’t very good at their jobs. I recently edited a piece of investment research by an analyst at a major investment bank, and it was an appalling piece of work in every respect.

There’s also a time-lag element. Sometimes analysts just don’t have the time to update their coverage. A company might report a bad quarter and the share price falls, but the analysts’ forecast remain where they were.

These don’t appear to apply here — although I can’t vouch for the quality of all the analysts. The stock’s covered by 17 of them, and with a market-cap of £44.8bn, it’s likely the biggest company in most analysts’ coverage.

Just how undervalued?

Well, according to their average forecast the stock’s undervalued by 43%. That suggests the market’s significantly overlooking this company’s potential.

On a statutory basis, the stock’s trading around 43 times forward earnings. And while that falls dramatically to 27.2 times by 2027, the adjusted figures are far more illuminating.

The current forecast suggests earnings per share of 399p for the year ahead and 442p for 2026. This gives us a price-to-earnings (P/E) ratio of 21.5 times for 2025 and 19.3 times for 2026. Of course, these figures mean nothing without context. Why would an investor pay 21.5 times earnings for the London Stock Exchange Group but may think twice about paying more than 16 times for a supermarket chain?

It’s all about the quality of the business and the potential for sustainable earnings growth. Quality’s often indicated by brand strength, market position, and margins.

In the first half of the year, the London Stock Exchange Group reported an adjusted EBITDA margin of 49.5% — up 100 basis points over a year. In other words, every £10 of sales is worth £4.95 of EBITDA.

Most other businesses, especially on the FTSE 100 which is dominated by mature business like banks and miners, can’t compete with this.

Everything considered

Despite everything I’ve said above, this isn’t a flawless company — anything but. Investors considering the London Stock Exchange Group should note that Annual Subscription Value isn’t particularly strong, especially as some products like Eikon being retired.

Remember, data and analytics are now the largest business in LSEG, responsible for nearly half the group’s total income. This is also where investors are keenly awaiting the fruits of a tie-up with tech giant Microsoft. Losing market share to Bloomberg or FactSet wouldn’t be a real concern.

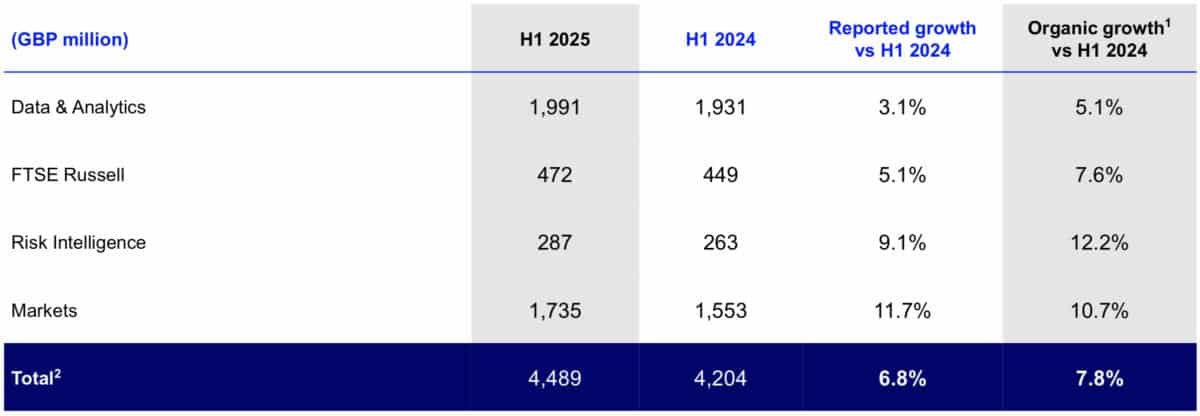

However, there are many reasons why I believe investors should consider this stock. I’ve noted a few, including the margins and the valuation. But the above snippet from the interim results highlights a diversified business with significant growth across multiple divisions.