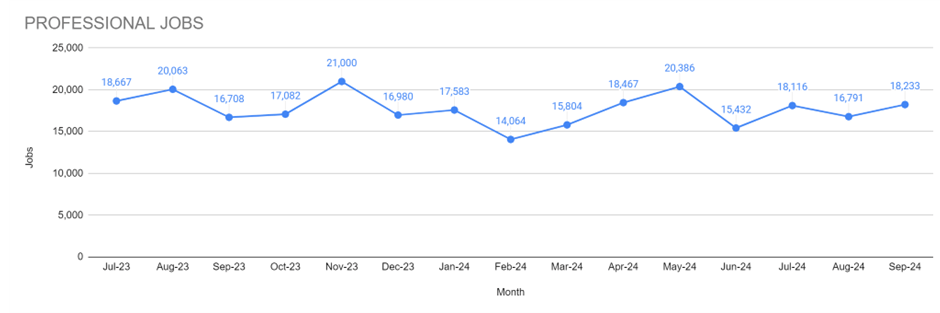

Morgan McKinley’s latest Quarterly Employment Monitor for Q3 2024 highlights key trends in Ireland’s professional job market, which has seen an overall decline in job vacancies, with a 2.1% drop compared to the previous quarter and a 4% decrease year-on-year. However, certain sectors are still experiencing growth, particularly in industries affected by regulatory changes and economic shifts, which are seeing targeted expansion despite the broader market decline.

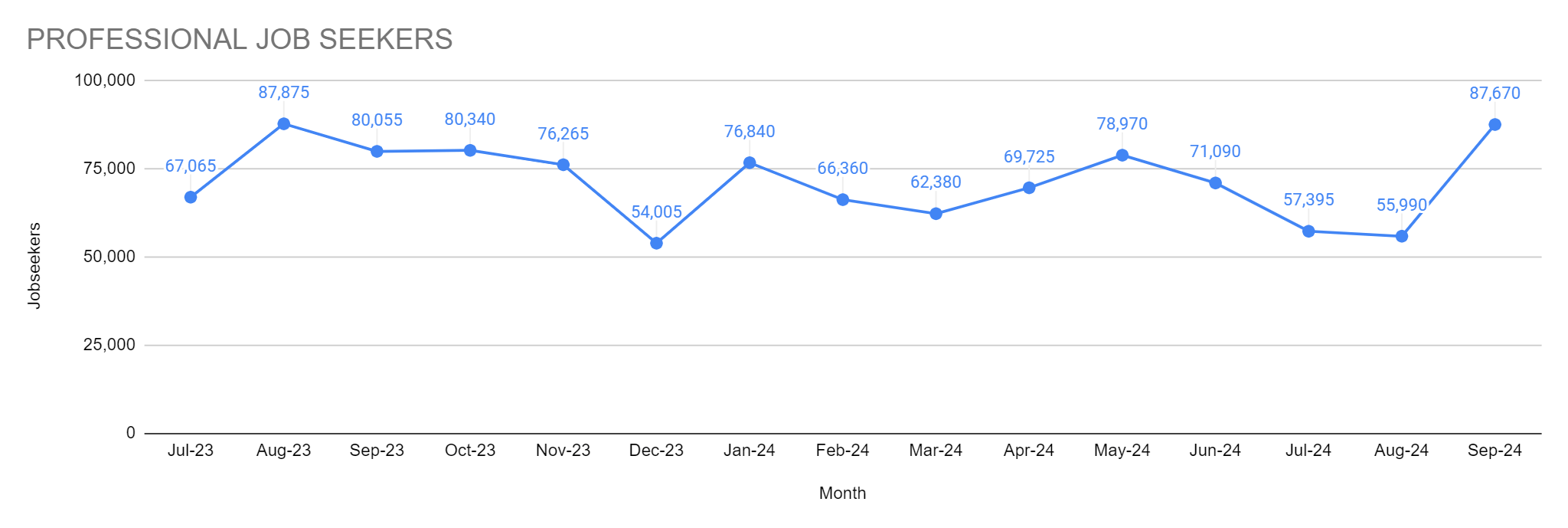

The Monitor also recorded an 8.5% decrease in professional job seekers between Q2 and Q3 2024. However, after declines in July and August, the number of job seekers surged by 56.6% between August and September.

While this 56.6% growth in professional job seekers represents a significant month-on-month increase, it aligns with similar trends seen during the same period last year, as many professionals initiate their job search ahead of the year’s end, aiming to secure new positions before the new year, alongside those impacted by Q2 2024 redundancies who took time off over the summer and are now re-entering the job market.

Despite these fluctuations, the outlook remains positive, with unemployment down to 4.3% in September. With Modified Domestic Demand (MDD) projected to rise, the Irish job market is expected to stabilise in the coming quarters. However, employers face growing challenges as they push for increased on-site presence, with many requiring employees to be in the office at least three days a week. This is narrowing the talent pool as more candidates prefer flexible or remote working options. Additionally, visa and permit complexities are further restricting international hiring, compounding skills shortages in key sectors.

Trayc Keevans, Global FDI Director, Morgan McKinley Ireland, said:

“While the labour market shows signs of contraction, it remains resilient. The slight decrease in job opportunities reflects an economy adapting to challenges, particularly around regulatory compliance and digital transformation. Companies are positioning themselves strategically, especially in sectors like technology and financial services, where compliance and operational resilience are essential. We are seeing increased demand for specialists who can manage these regulatory shifts effectively.

“In the technology sector, hiring remained steady, with a noticeable increase in permanent roles from late August through September, driven by anticipated headcount needs for 2025. Recent redundancies at large multinationals have also brought senior-level candidates into the market, many now open to contract roles, expanding the available talent pool.

As companies prepare for the Digital Operational Resilience Act (DORA), effective in January 2025, demand for cyber security and technology risk professionals has grown significantly. Employers are also enhancing data governance and compliance efforts, often leveraging AI and automation to streamline processes.

“Financial services followed a similar pattern, with increased hiring in compliance and risk management roles, particularly as companies prepare for the impact of DORA. Dublin saw heightened recruitment activity while contract roles grew moderately, providing flexibility for firms managing short-term regulatory needs.

“While Dublin’s accounting and finance job market remained stable, regional areas saw slower hiring over the summer. The renewable energy sector, however, continues to create opportunities for finance professionals, particularly in project financing. At the same time, demand for ESG reporting experts is rising, driven by EU legislation focused on transparency and sustainability.

The ongoing emigration of young professionals is worsening the talent shortage, making it harder to fill key roles. As a result, employers are prioritising local talent and returning Irish diaspora due to visa sponsorship challenges. Many firms are also increasing on-site presence requirements, further narrowing the talent pool as candidates favour remote or hybrid work.

“Engineering demand remains steady, particularly for project engineers tied to manufacturing expansions and new production lines. This trend is mirrored in pharmaceutical production, where contract recruitment has picked up due to rising global interest in Irish pharmaceutical products.

“In life sciences, companies are approaching hiring cautiously, driven more by attrition than expansion. This trend also extends to the legal sector, which remains modest overall but with slight growth in specialised areas such as renewable energy law.

“Construction remains one of the strongest sectors, driven by government infrastructure projects and residential developments under the National Planning Framework. However, employers are hesitant to hire international candidates due to employment permit and visa complexities and housing shortages, which could impact long-term growth in the sector.

“In business support, Dublin saw a moderate decline in hiring during the summer holiday period, while regional markets showed greater resilience. Companies are focusing on contract hires as they manage year-end budgets and prepare for future projects. However, the overall slow pace of recruitment and delayed feedback continues to challenge job seekers, particularly in administrative roles.

“Demand across executive and human resources sectors remains steady. Financial services firms are actively seeking executive talent skilled in risk management, technology risk, and regulatory readiness in preparation for DORA compliance. In human resources, the focus is increasingly on employee relations expertise, reflecting growing workplace challenges that require strategic management.”

Current most in-demand positions by discipline:

Technology: (Dublin) Software Developer, Cyber Security Analyst, Data Engineer, IT Risk & IT Audit professionals, Network Engineer. (Regional) IT Project Management Infrastructure, Software IT Project Manager, IT Business Analyst, Change Manager, Product Owner

Financial Services: Fund Accountant, Compliance Manager, Third-Party Risk Manager, AML/Fraud Analyst, Financial Reporting Manager.

Accounting & Finance: (Dublin) Newly Qualified Accountants, FP&A Manager, Finance Business Partner, Financial Accountant (1 to 3 years post-qualified experience), Credit Controller, Tax Accountant, Tax Manager, Tax Director. (Regional) Accounts Payable, Financial Accountant, Finance Business Partner, Accounts Assistant, Financial Controller.

Life Sciences: Quality Specialist, Validation Engineer, QC Analyst – Microbiology, QC Analyst – Chemistry, Quality Manager.

Engineering: Automation Engineer, Validation Engineer, Mechanical Project Manager, Quality Specialist, Quality Analyst, Injection Moulding Engineer, EHS Specialist, EHS Manager.

Projects, Transformation & Change: IT Project Manager, Business Project Manager, SAP Consultant, Business Analyst, Change Manager, Finance Transformation Manager, Scrum Master, PMO.

Business Support: (Dublin) Receptionist, Executive Assistant, Administrator, Office Manager, Legal Secretary. (Regional) Front of House Reception, Facilities Administrator, Executive Assistant, Clerical Officer, Document Controller.

Human Resources: HR Business Partner, Senior HR Business Partner, Employee Relations Specialist, HR Coordinator, HR Administrator.

Construction: Quantity Surveyor, Project Manager, Civil Engineer, Electrical Engineer, Mechanical Engineer.

Supply Chain & Procurement: Junior Warehouse Operators, Mid-level Procurement professionals, Planners, Junior to mid-level production professionals.

Marketing: Marketing Manager, Communications Manager, Events Manager, Marketing Executive, Digital Marketing Executive.

Sales: Business Development Manager, Area Sales Manager, Sales Representative, Commercial Manager, Account Manager

Legal: Aviation Finance Lawyer, Corporate Lawyer, Employment Lawyer, Company Secretary, Corporate Governance professionals.

Executive: CFO, Risk Executives (Technology Risk, Risk Management).

Statistical methodology

— Monthly new jobs and new candidates:

Monthly new jobs and new candidate figures are based on Morgan McKinley’s monthly records of new permanent and contract job vacancies and new candidates registering with the firm for employment. Statistics for the full market are derived using Morgan McKinley’s market share.

— Job classification:

Job vacancies are professional-level positions within the following sectors and functions: Legal, Financial Services, Technology, Accounting & Finance, Business Support, Sales & Marketing, HR, Multilingual, Supply Chain & Procurement, Life Sciences & Engineering, Project, Change & Transformation and Executive.

— Geography:

The data is based on new job vacancies and new candidates registered with Morgan McKinley’s network of Irish offices in Cork, Dublin, Galway, Limerick, and Waterford.