Conditions remain tough for FTSE 100 housebuilder Barratt Redrow (LSE:BTRW) as the UK economy splutters. In the first half, it reported an underwhelming 16,565 completions, missing its target range of 16,800-17,200 by a notable distance.

To add further woe, it also remains impacted by costly legacy building defects. It booked £248m worth of additional legacy property liabilities in January-June, largely due to fire safety and structural issues at previous developments.

At 373p per share, the FTSE company’s now trading at a 32.8% discount to what is was 12 months ago. Despite the builder’s problems, I think this may represent an attractive dip buying opportunity.

Indeed, City analysts believe Barratt’s share price could rocket almost 40% during the next year.

Recovery continues

While the firm’s recovery is slower than hoped, it is nonetheless still moving forwards. Its net private reservation rate rose 16.4% between January and June, to 0.64 per outlet per week. Its also reported that its forward order book had “continued to improve“: this was up 10.5% and 4.3% on a value and volume basis respectively in the first half.

Doubt remains as to whether Barratt can continue its recovery, but I’m optimistic it can. Interest rates are likely to continue falling as inflation recedes, supporting buyer affordability.

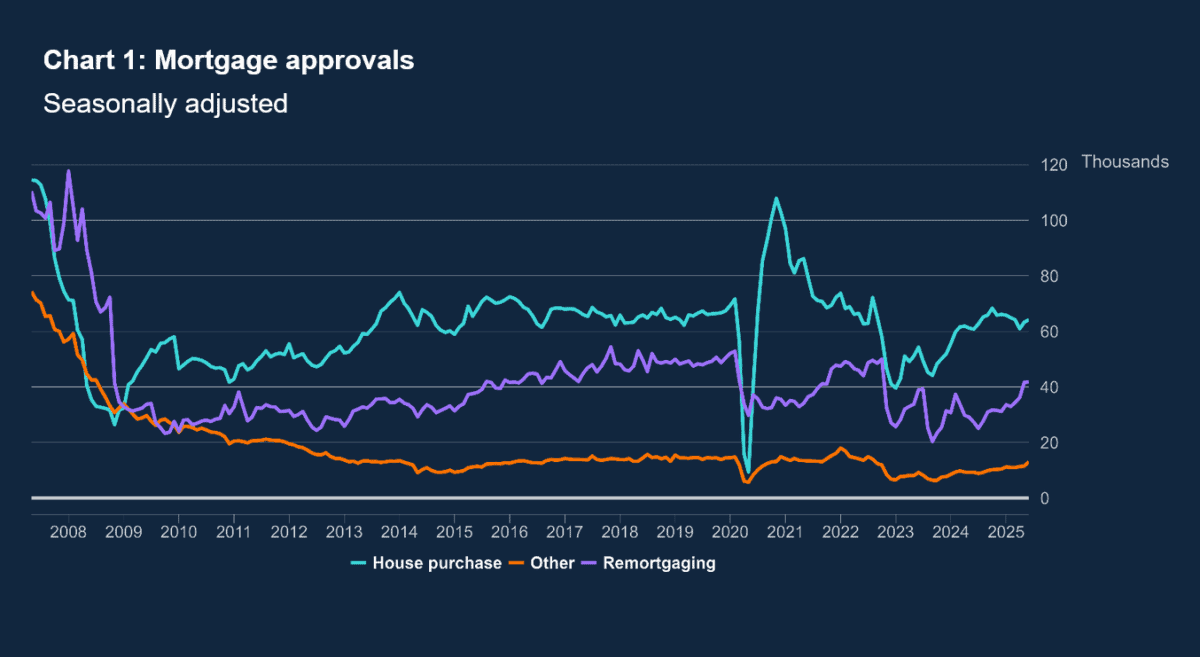

Underlining this support, latest Bank of England data showed net mortgage approvals for house purchases up 1.4% month on month in June.

Future rate cuts could be fuelled, too, by enduring economic stagnation, which may offset problems like rising unemployment on Barratt’s sales.

Value share

City forecasters are in agreement, and expect the builder’s profits to rise sharply over the next two years

A 49% year-on-year rise in annual earnings is tipped for this financial year (to June 2026). Predicted growth remains elevated at 31% for financial 2027, too.

These forecasts mean Barratt’s shares offer up strong value in my view. Its price-to-earnings (P/E) ratio of 12.6 times for this year drops to 9.6 times for next year.

Meanwhile, its P/E-to-growth (PEG) multiple is a stable 0.3 through the period. Any sub-1 reading indicates that a share is undervalued.

Finally, broker consensus also suggests strong dividend growth through the period. So the company’s forward dividend yields are a healthy (and rapidly increasing) 4.5% and 5.4% for financial 2026 and 2027, respectively.

Near-40% price gains

As with many UK shares, sharp economic conditions remain a problem for the company. But on balance, I’m confident Barratt’s bottom line can still steadily improve, pulling its share higher from today’s levels.

The 17 City analysts who rate the FTSE share all believe the builder will rebound. The consensus price target sits at 516.6p for the next 12 months. This suggests price upside of 38.5%.

Given the solid long-term outlook for homes demand, Barratt is a share I plan to hold for years. Its merger with Redrow last year gives it terrific scale to exploit this opportunity — the UK government is targeting 300,000 new homes each year between now and 2029.