Bitcoin has been navigating a turbulent landscape of volatility and erratic price action since the Federal Reserve announced an interest rate cut 20 days ago. This pivotal moment has left analysts and investors on edge, with many anticipating a significant rally for BTC in the coming weeks. Favorable macroeconomic conditions combined with the approaching halving cycle suggest that substantial gains could be on the horizon.

Critical data from CryptoQuant indicates a potential increase in Bitcoin demand as leverage trading activity reaches new highs. This surge in leverage trading typically signifies heightened interest and participation in the market, suggesting that traders are positioning themselves for a breakout.

If BTC can successfully breach its current resistance levels, a massive rally could be imminent, energizing the market and drawing even more participants into the fold.

The interplay of macroeconomic factors and technical indicators creates an intriguing backdrop for BTC’s price action, making it a focal point for traders and investors as they closely monitor the unfolding dynamics in the cryptocurrency landscape. With anticipation building, all eyes are on Bitcoin as it strives to reclaim bullish momentum.

Bitcoin Investors Seeking High-Risk Bets

Bitcoin appears poised for a massive rally, driven by the cyclical nature of its four-year halving and favorable macroeconomic conditions. According to key data from CryptoQuant, the market is gearing up for this potential surge, as evidenced by the rising demand for leveraged trades on exchanges, which indicates a positive trend.

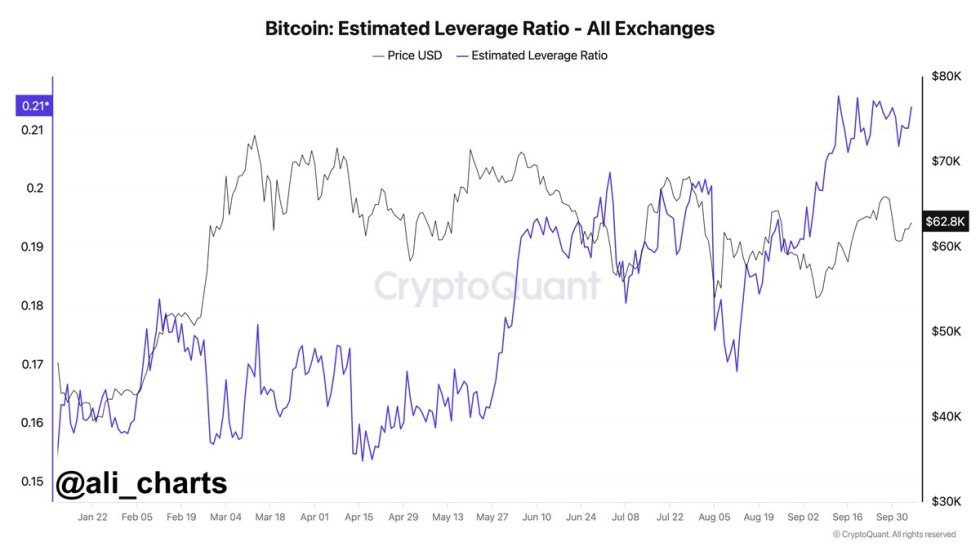

Top crypto analyst Ali recently shared a valuable CryptoQuant chart on X, highlighting that leverage usage across crypto exchanges is reaching new yearly highs.

The estimated leverage ratio for BTC on these exchanges is currently at 0.21, suggesting a significant increase in high-risk bets as more investors engage in leveraged trading. This uptick in leverage usage typically correlates with a heightened demand for Bitcoin, which can increase prices as traders amplify their positions.

However, it’s essential to recognize the risks associated with leveraged trading. While increased leverage can create a positive feedback loop, enhancing upward price momentum, it can also exacerbate losses if the market turns against traders.

If Bitcoin’s price declines, those holding leveraged positions may be forced to sell, leading to a sell-off that could negate any gains from the initial rally.

As Bitcoin navigates this critical juncture, the dynamics of leverage trading could play a pivotal role in shaping its price action. Investors must remain cautious, balancing the potential rewards of a rally against the inherent risks of leveraging their positions. With the halving cycle and rising leverage, Bitcoin’s path forward promises to be both exciting and volatile.

BTC Testing Key Resistance Level

Bitcoin is trading at $62,900 after struggling to reclaim the historically significant daily 200 moving average (MA) at $63,548. This key indicator is crucial for the bulls, as breaking above it would signal a potential shift in momentum and set the stage for a test of the recent highs around $66,000.

However, if BTC fails to surpass the daily 200 MA, the market sentiment may shift negatively. A drop below the psychologically important $60,000 level could trigger a deeper correction, with support levels around $57,500 coming into focus.

The next few days will be critical for Bitcoin’s price action. A successful break above the 200 MA would indicate bullish momentum and reinvigorate investor confidence in the upward trajectory of BTC. Conversely, a failure to reclaim this level could lead to increased selling pressure and a more significant pullback, testing buyers’ resilience in the market.

As traders closely monitor these levels, the coming sessions will reveal whether BTC can regain its bullish footing or face further challenges.

Featured image from Dall-E, chart from TradingView