The US-based consumers’ adoption of stablecoins is facing a slowdown in 2024 even when there is increasing activity in Bitcoin that rose in popularity following the launch of the spot Bitcoin exchange-traded funds.

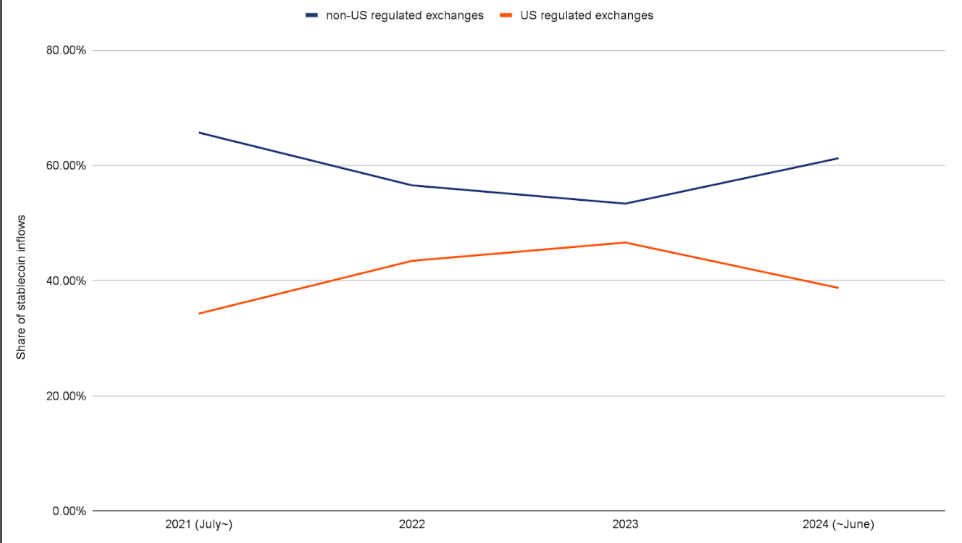

The graph below shows a decline in transactions by US-regulated platforms in just under a year. This can be attributed to the growing problem of US-based stablecoins in terms of regulation and adoption within the country.

This indicates that the stablecoins of emerging markets with bases outside the US are experiencing higher implementation. As stablecoins see increased use globally, this type of digital asset is being used to carry value and conduct cheap transactions in every nook and corner of the world.

Share of stablecoin inflows to exchanges regulated in the United States and those not regulated in the US. Source: Chainalysis

Global Demand For US Dollar-Backed Assets

As countries aim for a more stable asset base, usually in the form of the dollar, stablecoins will help enhance global financial inclusion, especially in areas where there are few, if any, stable currencies. Such a need for reliable and well preserved assets will fuel the use of stablecoins.

As of today, the market cap of cryptocurrencies stood at $2.26 trillion. Chart: TradingView.com

As 2022 ended, It was observed about $1 trillion in US dollars had been found abroad, which approximately equals to about half of the entire US dollar supply which just further emphasizes how stablecoins are increasingly replacing dollar cash in markets where local currencies are prone to volatility.

Image: Built In

The results align with the words of Paolo Ardoino, the Tether CEO, who recently stated that stablecoin demand mainly comes from developing countries like Argentina, Turkey, and Vietnam. In such regions, people seek stablecoins for protection against inflation and currency erosion and, hence, are increasingly applying them as financial instruments for everyday operations and deposit purposes.

Stablecoins: Regulatory Challenges And The US Position

The lack of an appropriate framework for digital assets puts the United States at a competitive disadvantage; financial hubs in Europe and the United Arab Emirates attract stablecoin projects because of much friendlier regulatory environments. According to Chainalysis, it has been pointed out by companies like Circle that the lack of a US regulatory framework for stablecoins could present a threat to American interests.

More countries are coming forward to set clear guidelines that encourage the use of stablecoins and the US isn’t left behind in the call to action; Chainalysis deems it to be this gap in regulation that will likely ensure the country remains competitive within the emerging digital asset landscape, providing the catalyst on innovation within the stablecoin market.

Featured image from Pexels, chart from TradingView