- Ethereum ETFs inflows are outdoing Bitcoin ETF inflows.

- BlackRock’s iShares Ethereum Trust (ETHA) ETF leads with a $89.51M inflow on Dec 23, 2024.

- This Market shift may signal an altcoin season in 2025.

In a surprising turn of events in the cryptocurrency market, Ethereum spot ETFs have been experiencing significant inflows, overshadowing the outflows noted in Bitcoin ETFs.

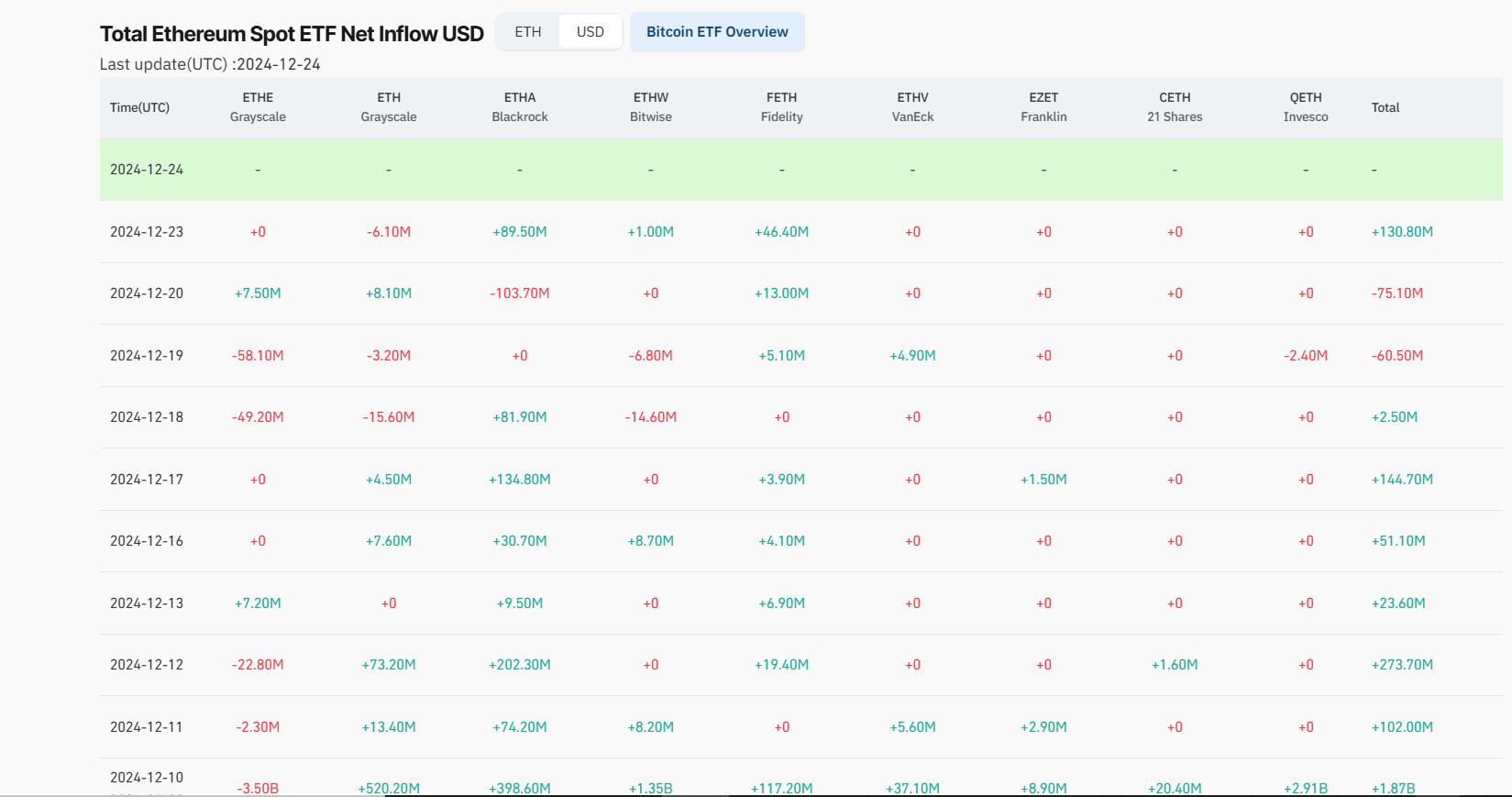

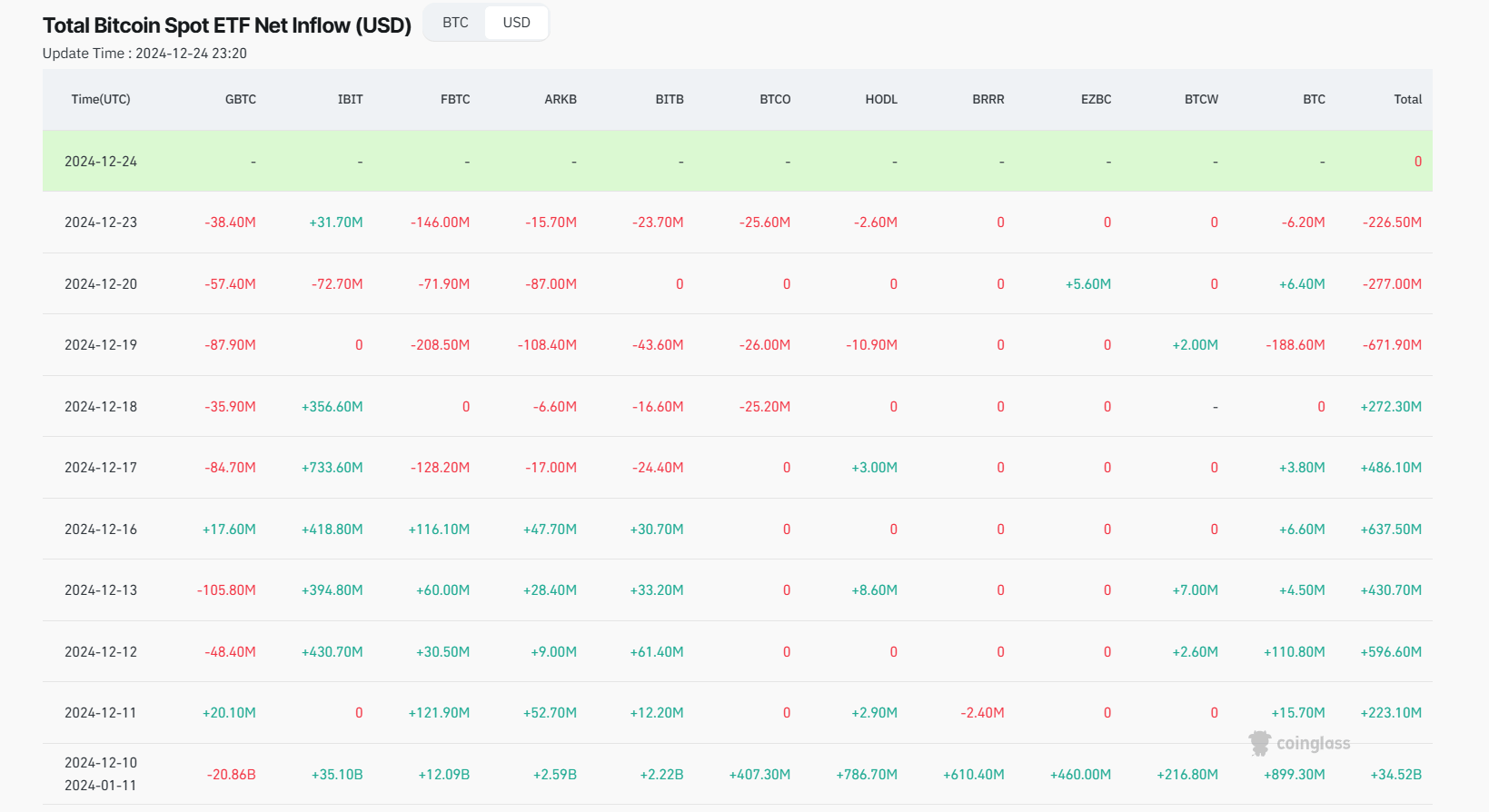

On December 23, 2024, Ethereum ETFs recorded a net inflow of $130.8 million, with BlackRock’s iShares Ethereum Trust (ETHA) ETF leading with $89.50 million and Fidelity’s Ethereum ETF (FETH) adding $46.40 million according to Coinglass data. In stark contrast, Bitcoin ETFs saw outflows totalling $226.50 million on the same day.

This trend has been consistent over recent weeks. For instance, on December 12, Ethereum spot ETFs had a cumulative net inflow of $273.70 million, continuing their streak of 14 consecutive days with positive inflows. BlackRock’s ETHA ETF alone saw a single-day net inflow of $202.30 million, while Grayscale’s Ethereum ETF (ETH) contributed $73.20 million.

The shift signals a possible start of an altcoin season

Bitcoin ETFs, despite having higher trading volumes, have been facing outflows, suggesting a possible shift in investor sentiment towards Ethereum.

Market analysts speculate that this could signal the onset of an ‘altcoin season’, where investors might be diversifying their portfolios beyond Bitcoin, with ETH leading the pack.

This shift in investment flow is particularly notable as it comes at a time when Bitcoin has been dominating headlines with its price performance, reaching over $108,000 earlier in December.

The underlying reasons for this trend might include Ethereum’s growing ecosystem, particularly in decentralized finance (DeFi) and non-fungible tokens (NFTs), which could be attracting investors looking for dynamic growth opportunities.

Additionally, the regulatory environment under the incoming administration might be perceived as more favourable for Ethereum, given its broader use-case applications beyond just being a store of value like Bitcoin.

This development raises questions about the future direction of crypto investments. While Bitcoin has long been the bellwether of the crypto market, Ethereum’s recent performance in the ETF space might hint at a rebalancing of investor interest, potentially leading to more balanced growth across different cryptocurrencies in 2025.