Looking at the share price of JD Sports Fashion (LSE:JD) over the past five years, it has moved in the right direction – but not dramatically. In that period, the shares are up 22%.

But if I had bought the shares five years ago and sold them in November 2021, I would have seen my holding increase by over 130% in value.

Since then, the share price has almost halved.

So, if I buy now, might I hope to see the price double again in the coming five years? After all, that would only require the shares hitting the same price that they reached in 2021.

Proven business model

Yes, I do think the shares could double in the coming half-decade.

I have added more to my portfolio in recent months precisely because I felt the share price looks attractive.

JD has a simple but proven model — a retail estate spanning physical stores and a big online presence, across markets from Europe to Australia to the USA.

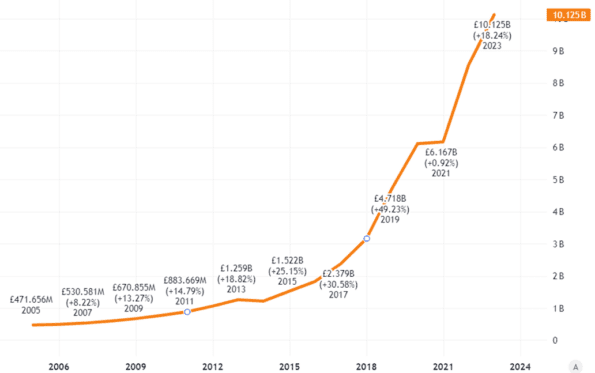

That has been the lever for explosive growth. Revenues have surged.

Source: TradingView

I expect that to continue. The company plans to open hundreds of new stores annually. Last year alone it opened over 200.

This expansion has added economies of scale and helped deepen the brand’s appeal, customer base and operational expertise. I think those are all competitive advantages.

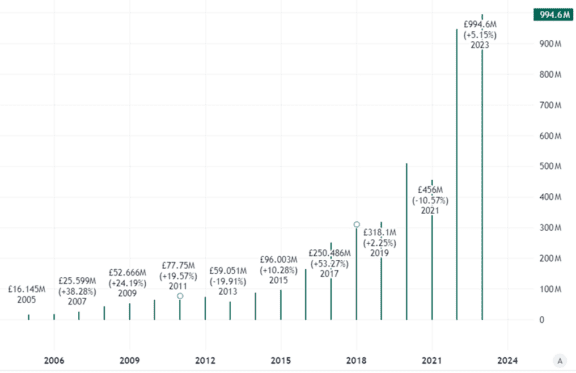

Not only has revenue soared, so has operating income.

Source: TradingView

Prospects of future success

But businesses can face lots of non-operating costs, especially if they want to spend money on significant expansion.

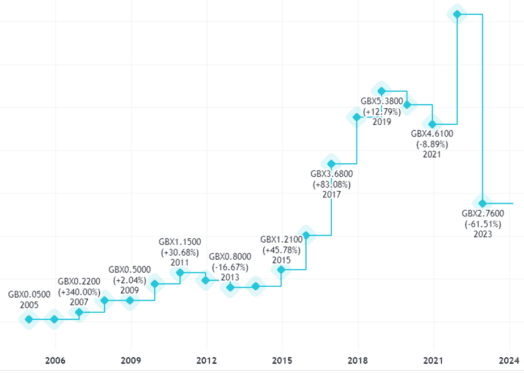

That helps explain why, despite operating income of close to £1bn annually, earnings per share at JD Sports are fairly small, at under 3p.

Source: TradingView

That suggests the company is trading on a price-to-earnings ratio of around 45. That does not sound cheap at all.

But with the company selling for around £6.4bn in total, while holding over £1bn in net cash, I think the valuation actually is attractive.

After all, the company seems to have strong growth prospects.

Upbeat trading statement

That has been affirmed today (28 March) after the release of a trading statement covering last year.

In January, the JD Sports share price crashed after a profit warning. It reduced forecast profit before tax and adjusted items for last year to be £915m-£935m. The business said today it has delivered on those expectations.

For the current year, before any accounting adjustments, it expects pre-tax profit of £900m-£980m. Seven weeks into its current financial year and trading has been in line with expectations, according to the update.

The sportswear market has been hugely competitive, leading to heavy discounting. That remains a risk to profit margins at retailers including JD Sports.

But in a tough market, it is holding its own and expanding.

I expect the company to grow sales significantly and see its price relative to pre-tax profit as a bargain.

Could we see the old JD Sports share price matched in coming years, meaning the shares double from today? Possibly, if earnings per share also grow strongly enough from where they are. The company could achieve that by cutting non-operating costs, growing revenues substantially or both. I see those as possibilities in coming years — but there is a lot of work still to be done.

/origin-imgresizer.eurosport.com/2023/08/22/3767514-76640208-2560-1440.jpg?w=150&resize=150,150&ssl=1)