- Bitcoin’s September rally, where the crypto rose 21%, was driven largely by Chinese stimulus packages.

- Market players are underwhelmed as the Chinese government’s stimulus plans did not live up to their expectations.

- Bitcoin failed to stay above $64,000 as the market seeks a catalyst despite ‘Uptober’ expectations.

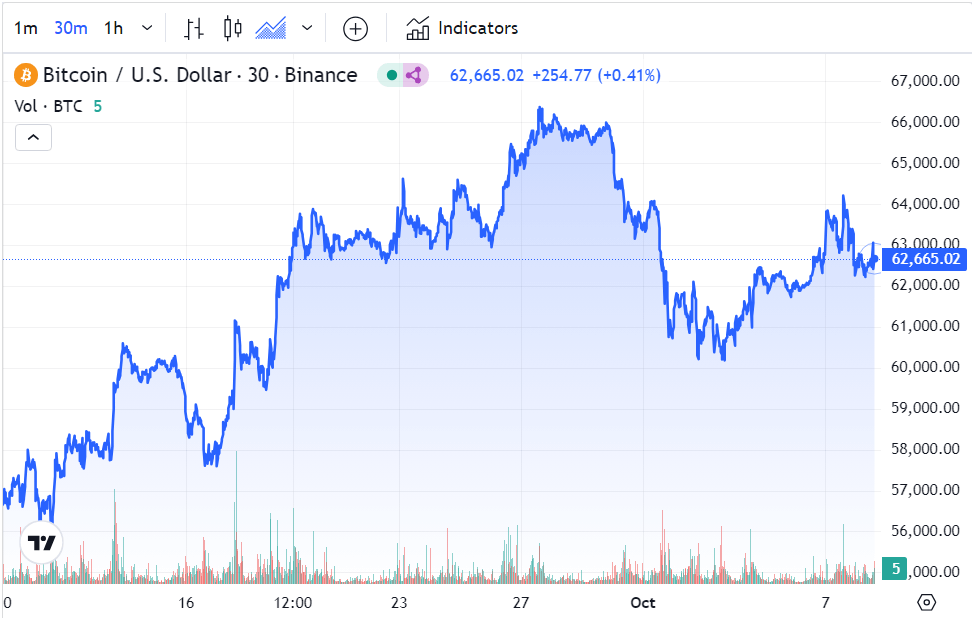

The most recent Bitcoin rally, which started in early September and is believed to have been driven largely by Chinese stimulus packages, has begun to fizzle out. The largest crypto by market capitalization briefly crossed the $66,000 mark on September 27th but could not sustain the rally. As of October 2nd, it fell to $60,000 and trades at $62,700.

Chinese stimulus

While September is historically a bearish month for cryptos, Bitcoin performed favourably last month driven largely by a stimulus program from the People’s Bank of China (PBOC) in response to slowing economic growth and Fed rate cuts.

The PBOC slashed rates on medium-term lending and the 7-day repo to boost economic activity, a measure known to improve sentiments around risky assets. Mortgage rates and minimum downpayment requirements for all types of homes were also slashed to support China’s housing market.

Expectations remained that the government would be willing to sustain its stimulus efforts through a multi-trillion-yuan spending plan; however, the government announced that it will frontload 100 billion Yuan from its 2025 budget in addition to another 100 billion to support the construction industry, a far cry from expectations.

Uptrend catalysts for the crypto market

The focus on Chinese stimulus comes at a point when the crypto market awaits a catalyst to spur a rally. The Fed’s 50bps interest rate slash in September is expected to herald a rally, but October has been underwhelming as Bitcoin struggles to break the $64,000 level and institutional inflows into US Bitcoin (and Ethereum) spot ETFs dwindle.

Bitcoin fell roughly 1% after the announcement of the government’s stimulus plans but recovered somewhat in the London trading session.