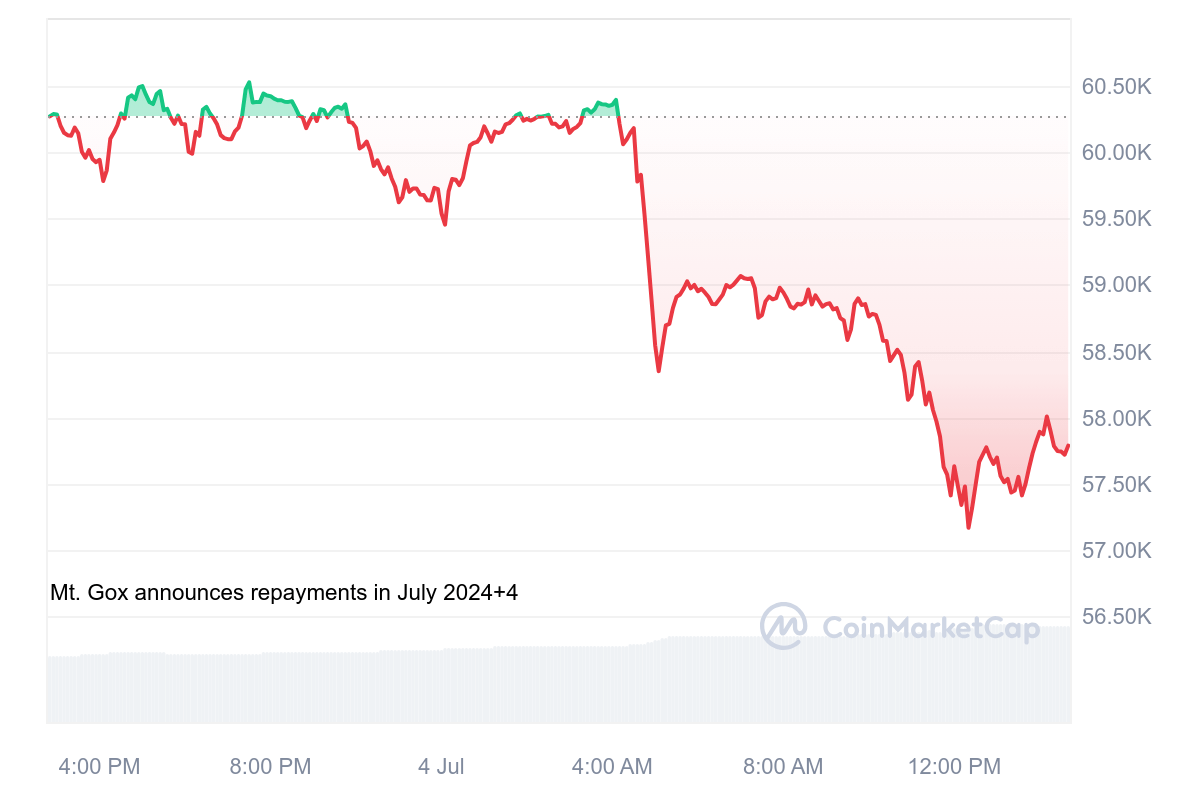

- Bitcoin price dropped below $58,000 on Thursday, touching lows of $57,166.

- The nearly 5% decline came amid fresh sell-off pressure, with whales and government wallets selling BTC.

Bitcoin traded to under $58,000 on Thursday, decreasing nearly 5% in 24 hours amid massive sell-off pressure. According to CoinMarketCap, BTC price reached lows of $57,166 across major cryptocurrency exchanges.

While price has recovered to above $57,800, Bitcoin remains down 3.9% in the past 24 hours and 5.4% in the past week.

BTC plunges below $58k as sell-off intensifies

Per data shared by Spot On Chain, Bitcoin’s sharp price decline today has come amid huge selling pressure.

On-chain data shows massive BTC offloading by government-linked wallets and whales, which the analyst says are reasons likely behind the dump.

One of these is a whale who moved 3,500 BTC worth over $206 million to Binance, with this unidentified large holder’s wallet still holding 4,368 BTC currently valued around $256 million.

The German government, which has actively sold BTC in recent weeks, also transferred more Bitcoin to exchanges today. On-chain data shows 3,000 bitcoins moved today, with 1,300 BTC going to different CEX platforms.

Also notable is the 237 bitcoin transfer by the US government wallet and another 1,023 BTC deposit to Binance by a whale.

Meanwhile, Mt.Gox repayments have reportedly began and this could add to more downside pressure for Bitcoin, Bitcoin Cash and other cryptocurrencies.

BTC could drop to $50k

Bitcoin recently rebounded from near $57k and the area looks to be a key area for bulls.

However, with increased pressure amid a broader market downturn could mean a fresh demand zone will be lower. Per analysts at IntoTheBlock, breaching $60k could see bears targeting lower support levels.

“Historically, demand just below $60k has been weak, suggesting further downward pressure. The next significant demand zone lies between $40,000 and $50,000,” the platform posted on X.

Meanwhile, former BitMEX CEO Arthur Hayes thinks the downside pressure for BTC is likely to continue “until morale improves.”