Bitcoin has shown remarkable resilience despite growing geopolitical turmoil. After days of uncertainty fueled by escalating conflict between Israel and Iran, BTC has held the crucial $104,000 support level and is now pushing into higher price territory. The strength in price action signals that bulls remain firmly in control, even as global markets remain on edge.

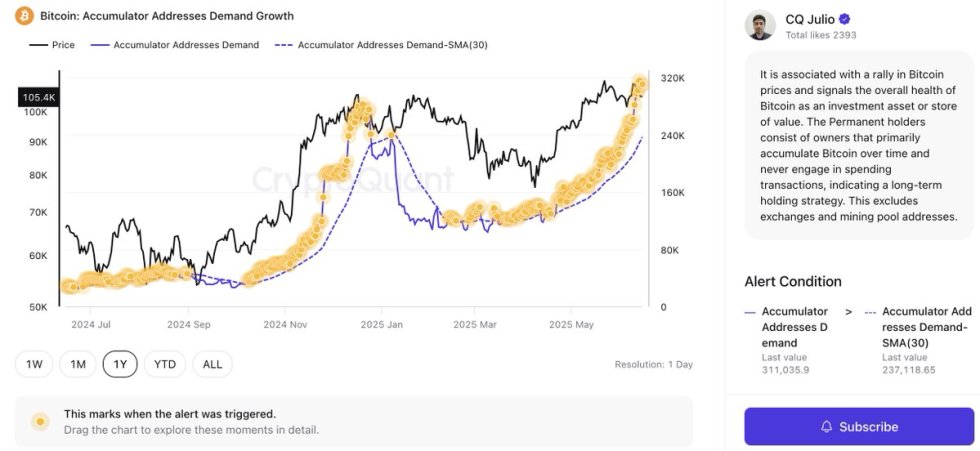

Fresh on-chain data from CryptoQuant highlights a key trend supporting this strength: Permanent Holder demand is accelerating. This cohort, often made up of long-term investors and institutions with high conviction, plays a vital role in Bitcoin’s supply dynamics. Permanent Holders are wallets that accumulate BTC without showing a history of regular selling. They typically represent the most committed participants in the ecosystem, often continuing to buy and hold regardless of short-term volatility.

With this trend gaining momentum alongside stable price support, Bitcoin appears well-positioned for another leg up—if broader macro conditions don’t derail the bullish setup. All eyes are now on the $109K and $112K resistance levels.

Consolidation Builds Strength As Permanent Holders Accumulate

Bitcoin has spent the past few weeks in a consolidation phase after a volatile first half of 2025. The year began with a wave of macroeconomic tension following newly imposed trade tariffs by US President Donald Trump, which disrupted global trade dynamics. Shortly after, rising US Treasury yields signaled growing systemic risk in financial markets, creating uncertainty across asset classes. Most recently, geopolitical fears intensified as conflict erupted between Israel and Iran, leading to spikes in oil prices and broad market unease.

Despite these headwinds, Bitcoin has remained impressively resilient. The asset has continued to hold above the critical $104,000 level, with bulls defending support and maintaining upward pressure. This stability, even during times of global unrest, points to growing investor confidence and the possibility of a major move to the upside.

Adding to this outlook, new insights from CryptoQuant show that Permanent Holder demand is accelerating. Permanent Holders—wallets that accumulate Bitcoin without showing a pattern of consistent selling—represent long-term conviction and reduced market liquidity. When demand from this cohort rises, it typically signals strong belief in future price appreciation and has historically preceded major bull runs.

This structural demand trend, combined with Bitcoin’s ability to weather macro volatility, suggests the market is quietly building strength for an expansive move. If geopolitical risks stabilize and macro conditions ease, BTC could break out from its current range and retest the $112,000 all-time high, potentially setting the stage for the next leg of the cycle.

BTC Bulls Push Back Above Key Moving Averages

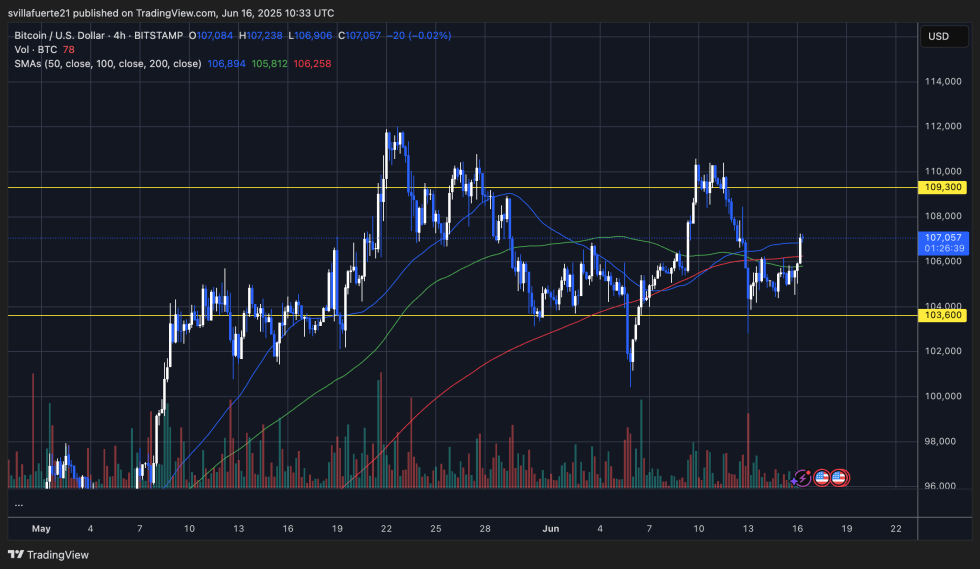

Bitcoin is showing signs of renewed strength after bouncing from the critical $103,600 support level. The 4-hour chart reveals a strong move above the 50, 100, and 200-period SMAs, indicating short-term momentum shifting back in favor of the bulls. BTC is now trading at $107,057, consolidating just below the $109,300 resistance—a zone that has acted as a significant ceiling over the past few weeks.

The move back above the moving averages, particularly the 200 SMA (red line), suggests that demand is picking up. Volume has increased during the recent push, validating the breakout attempt. The $103,600 level remains the key support to watch on any downside move, as it has consistently acted as a launch point for previous rallies.

To confirm a continuation of the uptrend, BTC must break above the $109,300 resistance with a strong candle close and ideally retest it as support. If rejected again, traders could expect a retest of the $105K-$106K zone, which aligns with the moving average cluster now acting as support.

Featured image from Dall-E, chart from TradingView

Editorial Process for is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.