Bitcoin is showing signs of recovery after enduring weeks of selling pressure that culminated in a sharp flash crash on October 10, when the price briefly dipped to around $103,000. Since then, BTC has rebounded modestly, now testing resistance near $111,000, a zone where sellers have historically stepped in. Despite the bounce, market sentiment remains fragile, with traders hesitant to call a clear bottom.

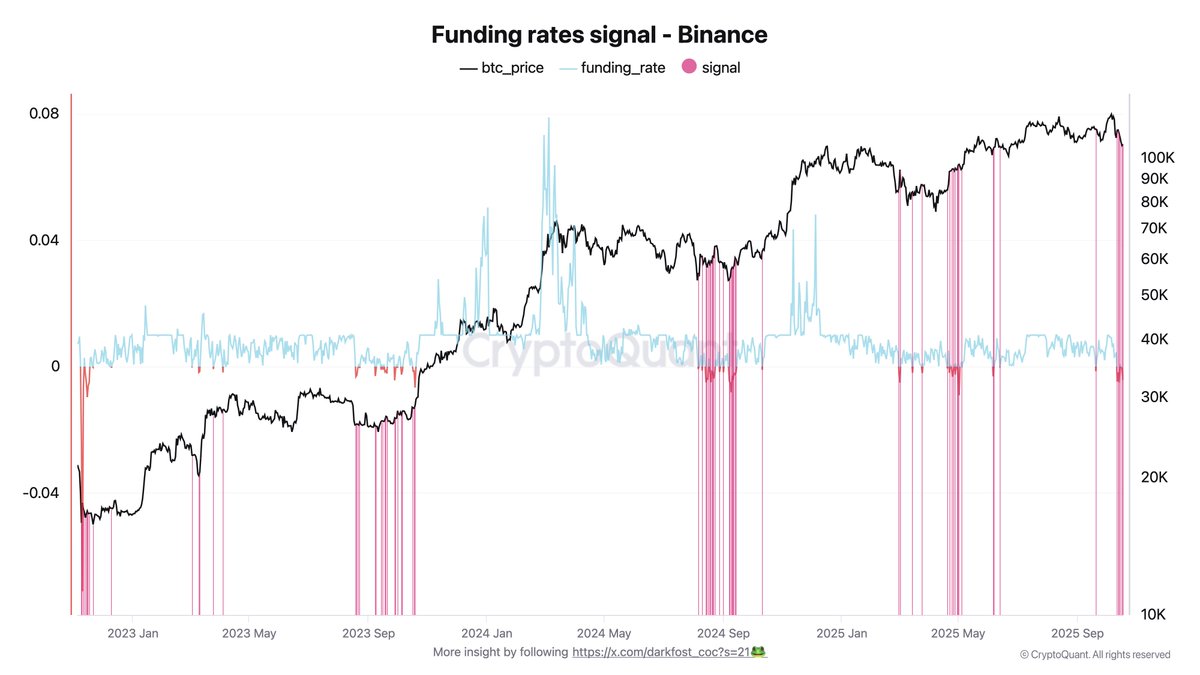

According to top analyst Darkfost, Bitcoin may be entering a new phase of disbelief — a stage often seen at the end of major corrections, when investors struggle to trust any sign of recovery. This shift is becoming increasingly evident in the derivatives market, particularly through funding rates, which reflect trader positioning and market bias.

On Binance, which still dominates global futures trading volume, funding rates have remained negative for six of the past seven days, currently sitting around -0.004%. This sustained bearish bias suggests that short positions continue to outweigh longs, as traders remain cautious after the recent liquidation wave. Historically, such persistent disbelief and short dominance have often preceded strong short squeezes or relief rallies.

Disbelief Could Set The Stage for The Next Big Rally

According to Darkfost, the current phase of disbelief could paradoxically become the foundation for Bitcoin’s next major rally. When traders remain overly bearish despite early signs of recovery, the accumulation of short positions can create a setup for a powerful short squeeze. In such scenarios, even a modest upward move can force short sellers to cover their positions, accelerating buying pressure and fueling a rapid price breakout.

If the current uptrend continues to build momentum, this wave of liquidations could push Bitcoin sharply higher. Darkfost points to key liquidity zones around $113,000 and $126,000, both areas where significant short positions are currently concentrated. As these positions unwind, BTC could see a chain reaction of forced buying — a dynamic that has historically triggered explosive moves.

Similar patterns have unfolded before. In September 2024, Bitcoin fell to $54,000 before rebounding above $100,000 for the first time, fueled by a large-scale short squeeze. Again, in April 2025, BTC surged from $85,000 to $111,000, and eventually to $123,000, following the same structure.

Darkfost suggests the market could now be entering another such phase of disbelief, where widespread skepticism masks underlying strength. If history rhymes, this doubt-driven environment may once again transform fear into momentum — setting the stage for Bitcoin’s next major move higher.

Editorial Process for is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.