The Aviva (LSE: AV.) share price has fallen about 4% in early trading after the insurer released its Q3 results today (13 November). Maybe that is due to profit-taking and some negative numbers as well as positives. But with the Direct Line integration on track, cost savings upgraded, and buybacks restarting, I can’t help but wonder – how high could the shares go from here?

Q3 update

General insurance premiums rose 12% to £10bn in Q3, with much of the increase coming from Personal Lines, where the acquisition of Direct Line helped drive 24% growth.

There were other notable growth drivers too. The partnership with Nationwide Building Society continued to add new business, while Commercial Lines grew 10%, reflecting the successful integration of Probitas.

In Wealth, net flows were up 8%, showing solid momentum. However, in the Retirement division, sales fell 27%. This was mainly due to tough competition in the fast-growing bulk purchase annuity market — an area that remains highly profitable but increasingly crowded.

Dividends

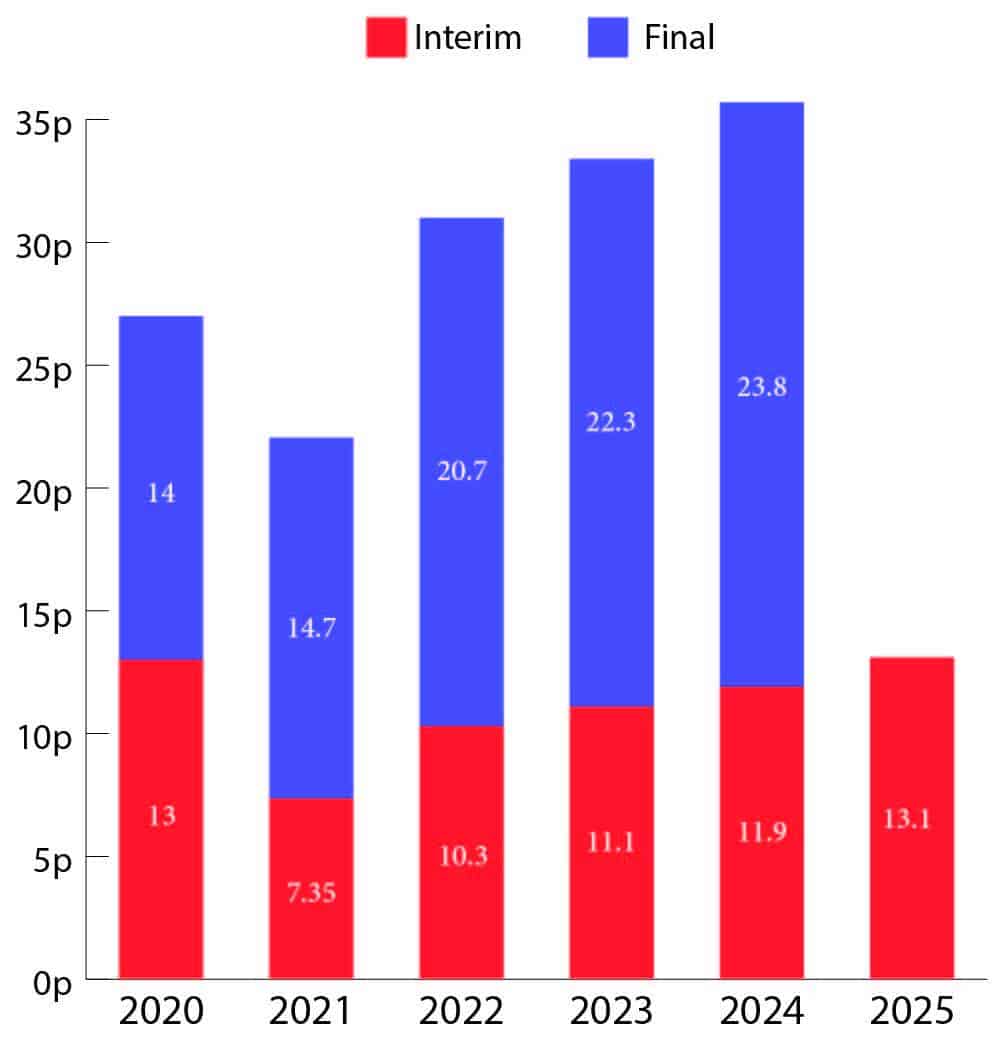

The insurer’s soaring share price despite Thursday’s dip does mean that it’s not quite the dividend superstar it once was. Even so, the 5.4% trailing dividend yield is still higher than the FTSE 100 average.

As the chart below shows, the dividend has been rising steadily over the past three years after being cut following Covid. The big question now is whether those payouts are sustainable.

Chart generated by author

Right now, dividend cover is 0.66 times earnings, meaning the company is paying out more in dividends than it makes in profits. That might sound worrying, but it doesn’t tell the full story.

If we look at cash flow instead of accounting profits, the picture is much stronger. The company’s operating cash flow was more than nine times the total dividend payment, suggesting the payout looks safe for now.

Risks

One key risk for Aviva comes from the bond market. Insurers invest heavily in bonds to generate income and help fund future policy payouts.

Rising unemployment and a weak UK economy mean the Bank of England is likely to cut interest rates again. Lower rates could hit Aviva investment income, which may weigh on future profits and dividends.

Corporate bonds carry extra risk. If some companies struggle in a slowing economy, defaults could rise, which may further reduce investment returns.

Even though the core insurance business remains solid, weaker investment income could limit profit growth and make it harder to maintain or grow dividends over time.

Bottom line

Aviva’s growth story remains compelling. The integration of Direct Line is delivering more quickly than expected, with £225m in cost synergies now targeted – twice the original forecast. That should mean more money flowing back to shareholders and less lost in running costs.

By 2028, Aviva expects more than 75% of its business to be capital-light, another win for investors as it frees up cash for dividends and share buybacks.

It’s also set ambitious new three-year targets. It’s aiming for operating earnings per share growth of 11% a year from 2025 to 2028 and an IFRS return on equity of 20% by 2028. These are all points for investors to consider when thinking about the stock’s future potential.