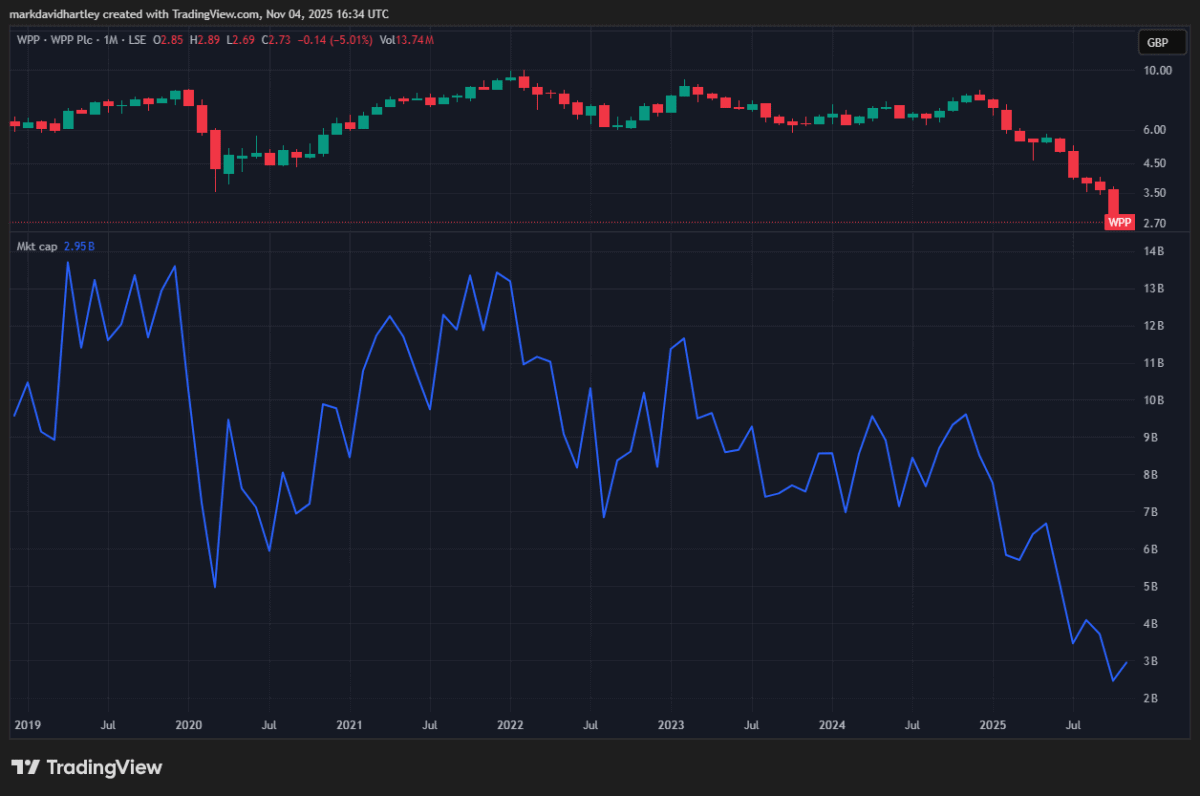

After falling 85% from its all-time high, WPP (LSE: WPP) now looks like a key contender to join the FTSE 250 in the next index reshuffle. In fact, there are now no fewer than 20 stocks on the mid-cap index with larger market-caps than it has. The worst of those losses occurred in just the past 11 months.

The price is down 70% since 13 December 2024, when the shares cost 893p. Now trading at around 273p, they’re at their lowest level since October 1998 — before the dotcom crash! And the FTSE 100‘s up 104% in the same time period.

It’s hard to believe that the company was worth almost £14bn just before Covid hit.

Why’s this happened?

The rapid rise of digital and artificial intelligence (AI)-driven advertising has been identified as a key contributor to WPP’s struggles. Unable to compete with technological challenges, it lost major clients such as Mars and Coca-Cola, leading to a sharp revenue decline.

Macroeconomic challenges further compounded this, leading to reduced advertising budgets, especially in key markets such as North America. Add to this costly leadership changes and you have the perfect storm to send a stock spiralling.

So that leaves the question: is WPP a lost cause or an opportunity hiding in plain sight for value investors?

Down. But not out

For those willing to play the long game, it’s fair to say that WPP could make a decent recovery. The company’s currently facing significant sector-specific headwinds but in the past, it was a titan of industry.

It couldn’t achieve that without the trappings of a well-run business. Therefore, it’s not unrealistic to imagine it could regain the success of yesteryear — if it can only navigate the challenges of the modern world.

Right now, AI’s causing significant disruption in several industries, particularly media. However, many of its uses are still being tested, and there’s little evidence to suggest it’ll fully replace services for many companies.

Rescue stations

Once the dust settles, we may find that traditional businesses still play a core role in media and other sectors. And with decades of experience, WPP’s well-positioned to take on that role.

Recently-appointed CEO Cindy Rose has taken the lead to implement operational changes amid all the financial stress. She’s already announced plans to streamline internal operations and focus on technology and enterprise solutions to revive growth.

Through a recent partnership with Google AI, the publisher plans to create a proprietary platform, WPP Open, using advanced generative AI tools. The aim is to enable faster creative content generation, from ad concepts to video narration and product images, greatly accelerating campaign production and reducing costs.

My opinion

In today’s AI-driven world, the future’s more uncertain than ever. Still, I think WPP has a good chance of bouncing back. With the price down 67% in a year, it now looks extremely undervalued. It has a forward price-to-earnings (P/E) ratio of 4.42 and a price-to-sales (P/S) ratio of 0.21.

At the same time, earnings are up 89% year on year, despite the sharp fall in revenue. So it’s still worth considering, in my view.

Naturally, any significant turnaround may take some time. But for those willing to wait, might this turn out to be the next Roll-Royce-style recovery story?