Data shows the Bitcoin Open Interest has set a new all-time high (ATH) as the cryptocurrency’s price has surged above $72,000.

Bitcoin Open Interest Has Shot Up Recently

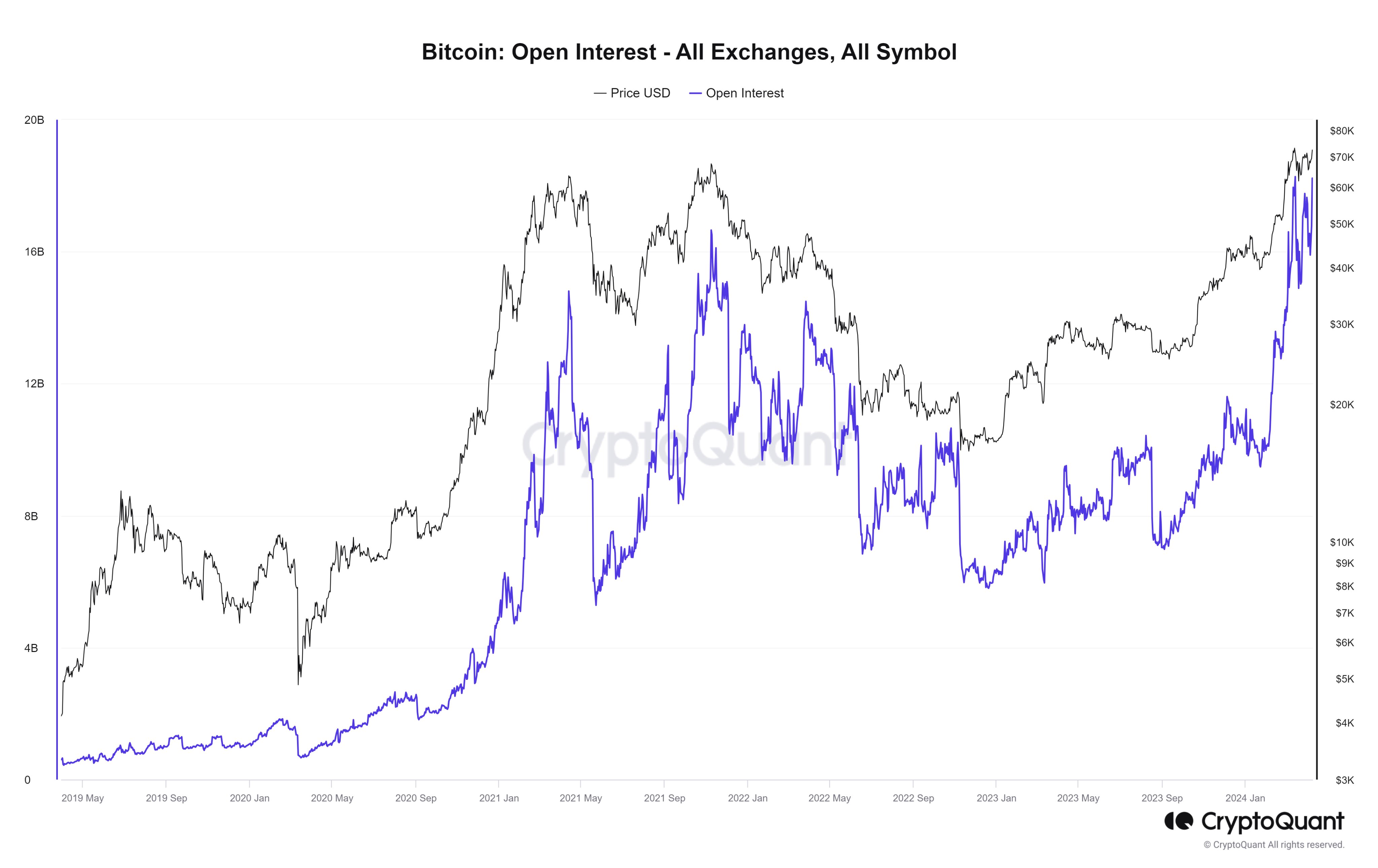

CryptoQuant Netherlands community manager Maartunn explained in a post on X that the BTC Open Interest has just reached a new ATH. The “Open Interest” is an indicator that tracks the total amount of Bitcoin derivative contracts currently open on all exchanges.

When the value of this metric rises, investors will open more positions in the derivative market right now. Generally, the total leverage in the market increases when this trend occurs. As such, the asset may be more likely to become volatile following an increase in the Open Interest.

On the other hand, the indicator going down implies the investors either are closing up positions of their own volition or are getting forcibly liquidated by the platform with which their position is open. Since the leverage would decrease in this situation, the price might become more stable.

Now, here is a chart that shows the trend in the Bitcoin Open Interest over the past few years:

The value of the metric seems to have been going up in recent days | Source: CryptoQuant

As displayed in the above graph, the Bitcoin Open Interest has registered sharp growth recently and has increased to a new ATH of around $18.2 billion. This surge has come as the price of the cryptocurrency has also rallied.

This trend isn’t anything unusual, as price jumps usually attract a large amount of attention to the cryptocurrency, and with it comes a new round of speculation on the derivative side.

The previous ATH of the indicator was achieved last month when Bitcoin set a price record beyond the $73,000 level. As mentioned before, though, the rising indicator can lead to more volatility in the price.

In theory, this volatility can go either way, but recent peaks in the metric have coincided with local tops in the price. The chart shows that the previous Open Interest ATH also unwound in a rapid decline for the asset.

It’s hard to say if BTC will follow a similar fate this time around, but what can be said is that it could probably become more volatile going forward if these extreme Open Interest levels persist.

As mentioned, the previous Open Interest ATH led to a sharp downswing for Bitcoin. During such price swings, a large amount of liquidations naturally occur.

Such liquidations, though, only feed further into the price move that caused them, thus elongating it. This then leads to even more liquidations, and the cycle continues.

This cascade of liquidations is known as a “squeeze.” The latest price rally has also triggered massive amounts of liquidations, as shorts across the cryptocurrency sector have taken a $108 million beating.

The liquidation data in the cryptocurrency sector for the past 24 hours | Source: CoinGlass

BTC Price

At the time of writing, Bitcoin is trading at around $71,500, up 5% over the last week.

Looks like the price of the coin has been rising recently | Source: BTCUSD on TradingView

Featured image from André François McKenzie on Unplash.com, CoinGlass.com, CryptoQuant.com, chart from TradingView.com

/origin-imgresizer.eurosport.com/2024/04/08/3945790-80129508-2560-1440.jpg?w=150&resize=150,150&ssl=1)