Bitcoin’s renewed price performance and resilience during previous roadblocks have sparked strong optimism among investors and traders about its potential for significant growth in the long term, as evidenced by a surge in new large BTC holders‘ balances.

New Whales Accumulating Bitcoin At A Fast Rate

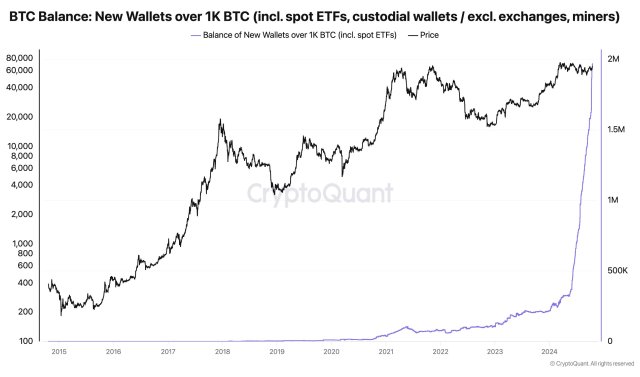

In light of heightened confidence in the general market, the number of new Bitcoin whale wallets has increased substantially as large investors keep hoarding the flagship cryptocurrency asset. CryptoQuant’s Chief Executive Officer (CEO) and founder, Ki Young Ju, reported the positive development in a recent post on the X (formerly Twitter) platform.

This rise in new whale wallet balance indicates that institutional and high-net-worth investors are becoming more confident in the crypto asset, which is seen as a bullish indicator for BTC. The whales seem to be taking advantage of BTC’s consolidation phase and possible future gains to increase their holdings, leading to an upswing in accumulation amid a broader market recovery.

According to Young Ju, the overall balance of these wallets, representing a notable portion of Bitcoin supply has surged to about 1.97 million BTC, indicating an over 813% Year to Date (YTD) growth.

With their BTC holdings rising 813% YTD, CryptoQuant CEO highlighted that the new whale wallets now own 9.3% of the entire supply, which is worth a whopping $132 billion. Excluding exchange and miner wallets, each has more than 1,000 BTC and an average coin age of less than 155 days, suggesting custodial.

Given the intensity of the increase, Young Ju initially thought there might be a flaw in the data as the numbers appeared excessively high. “To put it into perspective, it’s like institutional investors acquiring an additional 8.2% stake in a company named Bitcoin within a year,” he added.

Young Ju noted that the introduction of institution players has increased the diversity of the Bitcoin cap table. Thus, he claims the atmosphere around Bitcoin is maturing.

Active BTC Addresses Witnessing Huge Growth Since Last Month

The surge in new whale balance coincides with a significant increase in the number of BTC active addresses, signaling rising interest and activity from investors in the crypto network, possibly positioning themselves for an impending market shift.

According to CryptoQuant, there has been a substantial rise in BTC’s active addresses since September, following a period of poor price performance in July and August, which was accompanied by a fall in the metric.

CryptoQuant also highlighted that the growth has surpassed the monthly and yearly moving averages, reflecting an improvement in the network’s user engagement. It is worth noting that active user participation has historically been a crucial indicator of a bullish cycle since it shows that the network is experiencing renewed demand.

Featured image from Unsplash, chart from Tradingview.com