The FTSE 100 has risen almost 7% in the year to date as demand for blue-chip bargains has risen. Cheap Lloyds Banking Group (LSE:LLOY) shares have risen an even-more-impressive 17%, reflecting improving mood music around the UK’s economic and political landscape.

Yet today, this high street bank’s shares still look cheap. They trade on a price-to-earnings (P/E) ratio of 8.5 times, which is well below the Footsie average above 15 times.

Lloyds shares also offer excellent value on paper from a dividend perspective. Its 5.8% dividend yield is far ahead of the 3.6% average for Britain’s large-caps.

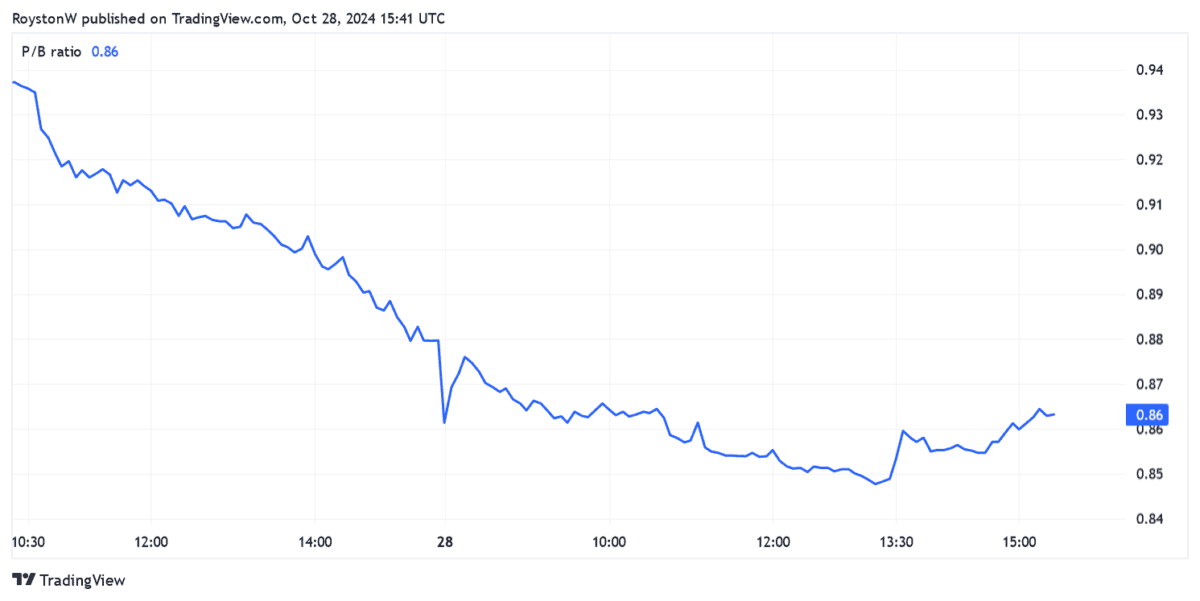

To top things off, the Footsie bank is also undervalued relative to the value of its assets. As the chart shows, its price-to-book (P/B) ratio is comfortably below the value watermark of 1.

On the bright side

Lloyds’ share price has chiefly risen on improving hopes for the UK economy. With growth picking up and interest rates falling, investors are more bullish on the firm’s revenues outlook and impairment forecasts.

The IMF’s decision to upgrade British GDP forecasts last week further boosted market confidence. Growth of 1.1% is now predicted for 2024, up significantly from 0.4% previously.

Lloyds shares have risen too, amid signs of a steady recovery in the housing market. This is especially important to this bank given its status as the country’s largest home loan provider.

Possible car crash

However, there are also significant risks facing Lloyds in the short term and beyond. In fact, I fear they could prompt a sharp re-rating given the bank’s recent share price jump.

One large and growing threat is the potential for substantial financial penalties if found guilty of overcharging on car loans. Things have become more precarious after Friday’s Court of Appeal ruling that motor dealers’ commissions should be approved by borrowers before execution.

Lloyds’ share price has fallen sharply following the news. It’s set aside £450m to cover claims, but could face a substantially higher bill running into billions.

It said today that last Friday’s ruling “sets a higher bar for the disclosure of and consent to the existence, nature, and quantum of any commission paid than had been understood to be required or applied across the motor finance industry prior to the decision.”

Lloyds added it’s “assessing the potential impact of the decisions, as well as any broader implications.” This uncomfortable reminder of the expensive PPI scandal after 2008 could have similar adverse consequences for the Black Horse Bank.

Too risky

While significant, this isn’t the only big risk to Lloyds and its share price right now.

Margins are being impacted as the Bank of England cuts rates and competition in UK banking heats up. These dropped 20 basis points to 2.94% in quarter three, and could have much further to fall.

Remember too, that the UK’s economic recovery remains on fragile ground. A range of factors, from the fallout of this week’s Budget to the US Presidential election in November, could harm growth and with it the fortunes of cyclical banks.

I think the dangers of owning Lloyds shares outweigh the potential rewards, even at today’s price.